Right-wing influencer Nick Fuentes urged his followers to abandon President Donald Trump and the Republican Party over the military attack against...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Headings :

Maroc - NEWSDAY.CO.TT - A la Une - 01/09/2024 07:39

Maroc - NEWSDAY.CO.TT - A la Une - 01/09/2024 07:39

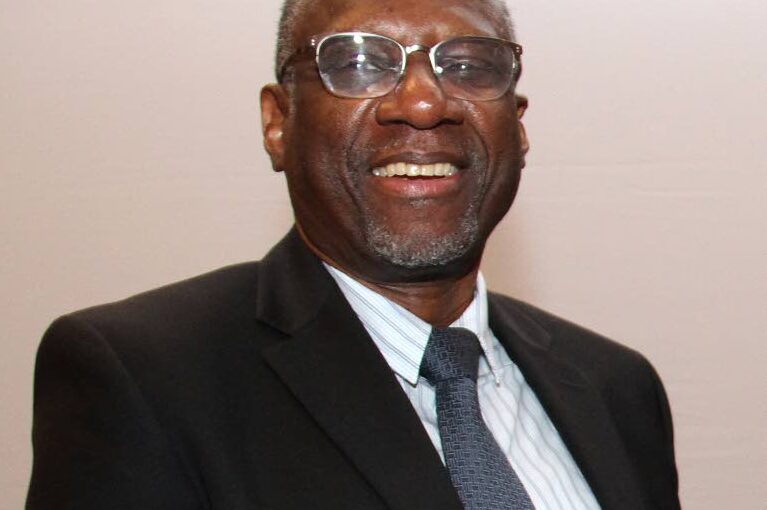

Farrell: Forex flows difficult to follow

FORMER Central Bank deputy governor Dr Terrence Farrell says the removal of exchange controls when the Trinidad and Tobago dollar was floated has made it a challenge to find out where exactly do flows of foreign exchange (forex) go. Farrell also said there is no evidence to suggest that approximately $25 billion in forex has been lost over time or that any leakages of forex from the financial system are the result of crime. He made these comments at a virtual conversation about forex leakages in Trinidad and Tobago and its impact on trade and development outcomes, hosted by UWI's Department of Economics on August 30. "In 1993, we floated the exchange rate. But we didn't just float the exchange rate. We abolished exchange controls." Farrell added that the latter happened on Trinidad and Tobago's capital and current accounts. "This was unprecedented at the time for a country like Trinidad and Tobago." Abolition of exchange controls on the capital account, he continued, meant that "if Trinidad and Tobago wants to invest overseas it does not need to go to Central Bank to get any money." Farrell said, "That change that we made in 1993 was a profound change in the arrangement." He added that the abolition of exchange controls meant Central Bank no longer has access to information regarding these kinds of transactions. Farrell recalled that years ago people needed traveller's cheques to pay for their expenses overseas "With the advent of credit cards, it meant people no longer needed to get traveller's cheques to travel," he said. Farrell added that totalling the number of traveller's cheques a person requests could give a rough estimate of the amount of money that people spent when they were travelling abroad. "Now people have credit cards which they can use to pay for anything." He said these developments have made it more difficult for the Central Bank to estimate how forex flows operate. "Financial flows could be identified. But the purpose would not be apparent." Against this background, Farrell said neither commercial banks nor the Central Bank would know "whether you bought a book or you bought a holiday in the Mediterranean." Farrell added this was a matter of non-classification and not misclassification. "That is not based on the money missing, the money disappeared. We've spent it. Yes, it is true that the money is gone because we have spent it already." While some people may argue that capital flight is taking place, Farrell said, "I just want to point out again that one of the things that happened in 1993, the abolition of exchange controls, is that we also gave up the 'surrender requirement.'" He added this involved people who acquired forex to surrender it to the Central Bank. "The law now is that anybody can have an account anywhere in the world they want to." Farrell said people are now allowed to have US dollar accounts in local banks. He estimated there was at least US$4 billion "sitting there that belong to residents of Trinidad and Tobago." Farrell added there is an unknown amount of money from Trinidad and Tobago nationals is being held in overseas bank accounts. "Since 1993, we have had legal authority to move capital, wherever it is we want to keep it." He also said suspicious transaction activity reported by the Financial Intelligence Unit (FIU) does not always translate into money laundering or forex leakage. UWI economist Dr Roger Hosein expressed concern that the level of crime was not creating an enabling environment to encourage investment which could increase the amount of forex coming into Trinidad and Tobago. He claimed that Trinidad and Tobago could be in the top ten worst-performing economies in the world, in terms of economic growth performance. "It worries me because it points to a deep, underlying structural problem." Hosein promised to continue his advocacy for the establishment of a national statistical institute. Economist Marla Dukharan expressed a similar concern. She said better systems were needed to better capture the flows of forex into and out of Trinidad and Tobago. The post Farrell: Forex flows difficult to follow appeared first on Trinidad and Tobago Newsday.

Articles similaires

Far-right influencer urges followers to 'vote Democrat' and abandon GOP over Iran war

Right-wing influencer Nick Fuentes urged his followers to abandon President Donald Trump and the Republican Party over the military attack against...

Trump warned Iran will hurt him even more than Epstein: 'Could split his party in half'

President Donald Trump's invasion of Iran might actually do more damage to his electoral coalition than his mishandling of the Jeffrey Epstein sex...

Experts seek deeper PPP to address burden of Osteoporosis in Nigeria

By Chidinma Ewunonu-AlukoHealth experts have called for greater public awareness, early prevention and stronger government-private sector...

Trump signals new war is coming as he brings it up to CNN reporter 'without being asked'

President Donald Trump changed the topic from his war in Iran to preview a possible invasion of another country during a phone call with CNN's Dana...

Trump signals new war is coming as he brings it up to CNN reporter 'without being asked'

President Donald Trump changed the topic from his war in Iran to preview a possible invasion of another country during a phone call with CNN's Dana...

Experts seek deeper PPP to address burden of Osteoporosis in Nigeria

By Chidinma Ewunonu-Aluko, Ibadan Health experts have called for greater public awareness, early prevention and stronger government-private sector...

Experts seek deeper PPP to address burden of Osteoporosis in Nigeria

By Chidinma Ewunonu-Aluko, Ibadan Health experts have called for greater public awareness, early prevention and stronger government-private sector...

Trump does not rule out deploying troops directly to Iran

U.S. President Donald Trump did not categorically rule out the possibility of deploying American troops directly to Iranian territory, UATV English...

Trump does not rule out deploying troops directly to Iran

U.S. President Donald Trump did not categorically rule out the possibility of deploying American troops directly to Iranian territory, UATV English...

Latest releases

-

Aucun élément