FORMER prime minister Dr Keith Rowley has warned the government’s plan to reopen the Pointe-a-Pierre refinery could expose taxpayers to new...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - 11/07/2024 23:28

Maroc - NEWSDAY.CO.TT - A la Une - 11/07/2024 23:28

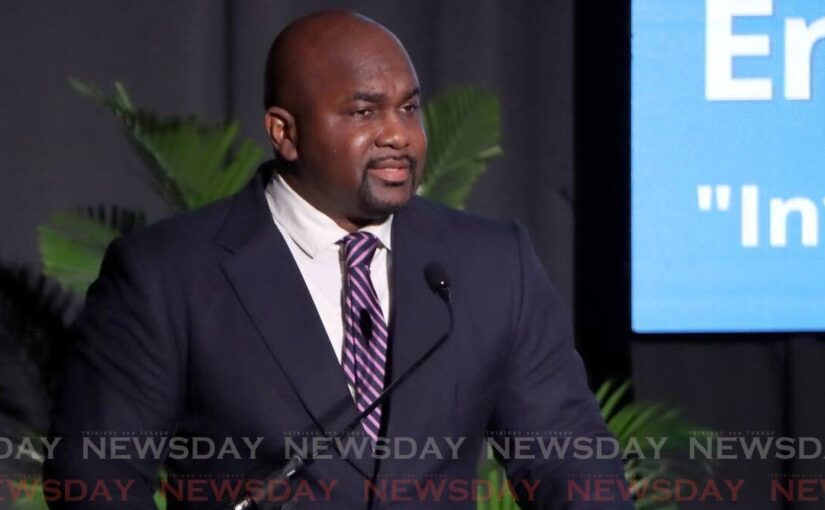

OCM shareholders reject government-nominated board members

SHAREHOLDERS of One Caribbean Media (OCM), parent company of the Trinidad Express Newspaper, CCN TV6 and i95.5 FM, rejected the nomination of government-nominated board members at its annual general meeting on July 11. Government-owned National Investment Fund (NIF) nominated executives Dale McLeod and Shakka Subero to be directors at the OCM board. The representative for NIF called for a poll on shareholders' consensus on the appointment. After the poll 23,997,642 votes went against McLeod’s appointment while 23,229,443 votes were for his appointment. A total of 28,684,368 votes went against Subero’s appointment and 23,229,443 votes went for his appointment. Other nominated members, Gregory Thompson and Grenville Phillips were elected on to the board. On July 3, Minister in the Ministry of Finance Brian Manning had defended the government’s move to appoint the two members to the board of directors. Responding to questions posed by senator Wade Mark at a sitting of the Senate, Manning said the decision to appoint the two members was not an attempt to interfere with the freedom of the press, but part of its fiscal responsibility, being one of the company’s largest shareholders. The government acquired 15,286,000 shares in OCM through the Clico bailout in 2018, making it one of the largest shareholders of the company, owning 23 per cent of the company’s shares. At the Senate Manning said the value of the shares went down by 69 per cent, from $12 a share in 2018 to $3.68 in 2024, reducing the taxpayers’ asset value to $56.2 million. “Having seen its shareholdings, and by extension the people’s shareholdings in OCM, reduced in value by over $100 million with no sign of recovery in value in the near value under the present board, it is now considered necessary for the largest shareholder in OCM to be present in the corporate decision making at the company,” Manning said. OCM’s consolidated audited results for the year ending December 31, 2023 revealed that the company earned $317.9 million in revenue as compared to $328 million in 2022. The company’s gross profit was $91.8 million for 2023, as compared to $96.2 million. After taxes, OCM’s profit for the year was $30.4 million, as compared to $28.5 million in 2022. Newsday attempted to contact Manning for comment on the shareholder's rejection, but calls to his phone went unanswered. However, UNC Senator Wade Mark said the rejection struck a blow for press freedom in the country, the region and even the world. “Press freedom is an entrenched provision in the constitution,” Mark said. “The framers of our Constitution sought to ensure that for democracy as we know it to strive, grow and flourish, you need a fearless, independent media, known as the fourth estate… Any attempt by a marauding government, one that has lost its way, has to be exposed and stopped.” He accused the government of seeking to control all independent institutions under the Constitution. He said a government’s influence in the form of board members could undermine the independence of the media. “The government already has control over TTT. It already has an indirect and direct interest over the Ansa Mc Al Group (owners of Guardian Media). I don’t care how many shares the government owns in a media house or group, that government should keep its hands completely off the media.” “Yes, they have shares, but take your dividends and go.” The post OCM shareholders reject government-nominated board members appeared first on Trinidad and Tobago Newsday.

Articles similaires

Rowley warns government: Leave Paria out refinery sale

FORMER prime minister Dr Keith Rowley has warned the government’s plan to reopen the Pointe-a-Pierre refinery could expose taxpayers to new...

EU report urges reforms to strengthen media Independence and transparency

(Kaieteur News) – The European Union Election Observation Mission (EU EOM) has called for strengthening the independence of the Guyana National...

EU report urges reforms to strengthen media Independence and transparency

(Kaieteur News) – The European Union Election Observation Mission (EU EOM) has called for strengthening the independence of the Guyana National...

Sando mayor awards four with keys to the city

HISTORY was made on November 18 when San Fernando mayor Robert Parris broke with tradition and presented four keys to the city—rather than the...

Sando mayor awards four with keys to the city

HISTORY was made on November 18 when San Fernando mayor Robert Parris broke with tradition and presented four keys to the city—rather than the...

CLF corruption investigation ‘scared off’ Trincity Mall buyers

The liquidator managing the winding up of CL Financial Ltd has submitted its latest report to the High Court, reporting continued progress in asset...

BitMine Appoints New CEO and Three Board Members

BitMine has sparked discussion following the appointment of new leaders for its Ethereum-focused firm.

Les derniers communiqués

-

Aucun élément