City watchdog publishes details of its plans to regulate the BNPL market, which has now grown to £13bn...

Vous n'êtes pas connecté

Rubriques :

- CYPRUS-MAIL.COM - A la Une - 18/Jul 13:47

- CYPRUS-MAIL.COM - A la Une - 18/Jul 13:47

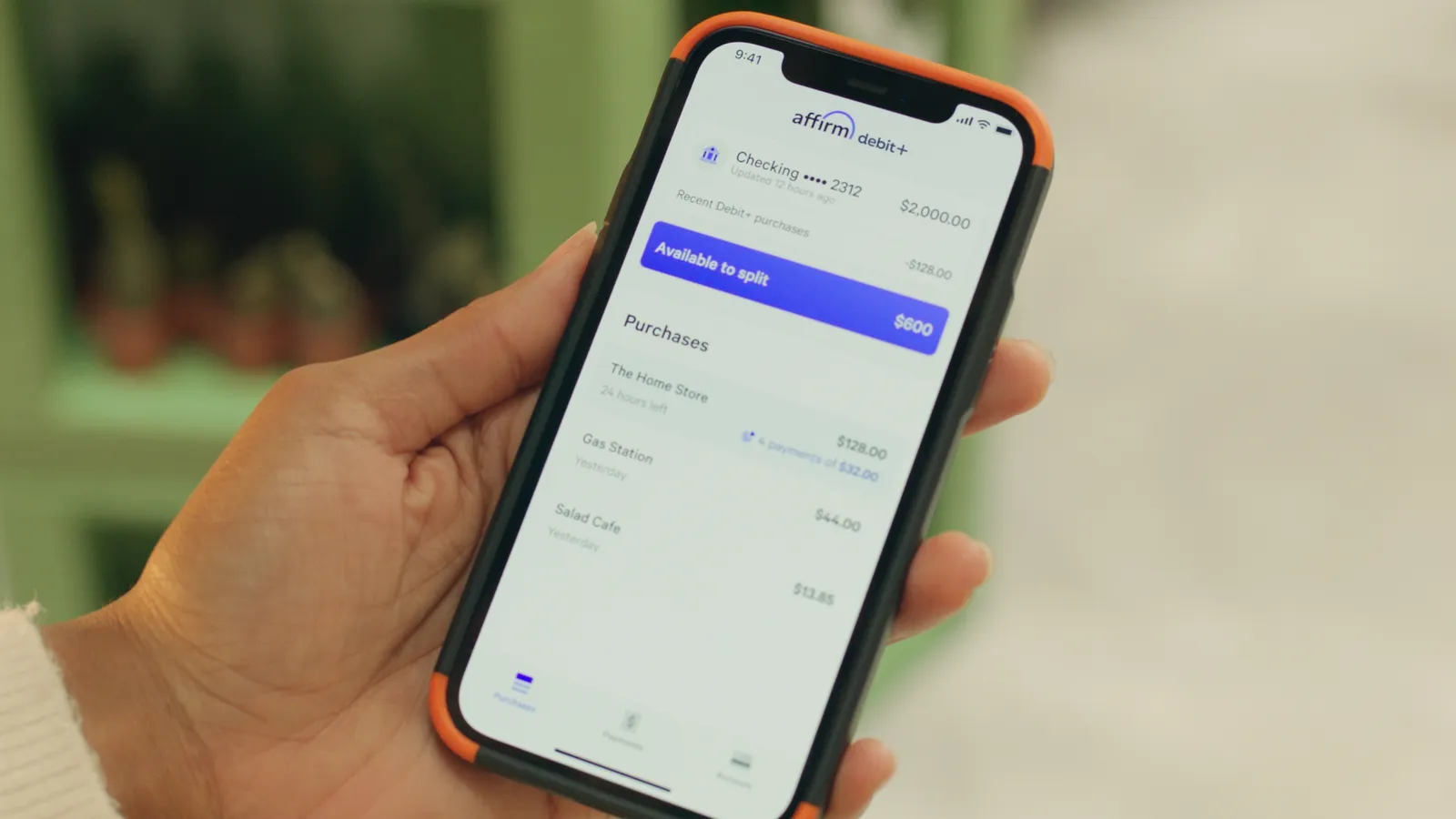

FCA plans safeguards for buy now, pay later customers

Britain’s financial regulator on Friday unveiled proposed measures aimed at safeguarding consumers who use buy now, pay later (BNPL) services. The draft rules include affordability assessments, improved access to the Financial Ombudsman Service for filing complaints, and enhanced support for borrowers facing financial hardship. “Checks on whether people can afford to repay, assistance when problems […]

Articles similaires

New ‘buy now, pay later’ affordability checks may cover even smallest loans

City watchdog publishes details of its plans to regulate the BNPL market, which has now grown to £13bn

HUD studies BNPL housing risks

U.S. regulators want to learn more about how buy now, pay later loans may affect borrowers’ finances and housing market stability.

Buy now, pay later affordability checks to come into force

Long-promised regulation of the sector will come into force next July, but lenders will have some flexibility.

FICO reporting could stunt BNPL

If buy now, pay later firms know when consumers borrow heavily or fail to make repayments, providers may be reluctant to offer their payment services...

FICO reporting could stunt BNPL

If buy now, pay later firms know when consumers borrow heavily or fail to make repayments, providers may be reluctant to offer their payment services...

Buy now, pay later consumer protections proposed by Financial Conduct Authority

The rules will give consumers more transparency over what this type of borrowing involves.

Zambry tells university students not to fall into BNPL debt traps

KUALA LUMPUR: The Higher Education Ministry is working to determine how many students have been affected and burdened by ‘Buy Now, Pay Later’...

Les derniers communiqués

-

Aucun élément