As part of its commitment to empower women with relevant entrepreneurship skills, leading financial institution, Fidelity Bank Plc, partnered with...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Maroc - MOCKINBIRD.COM.NG - A La Une - 08/Aug 13:05

Maroc - MOCKINBIRD.COM.NG - A La Une - 08/Aug 13:05

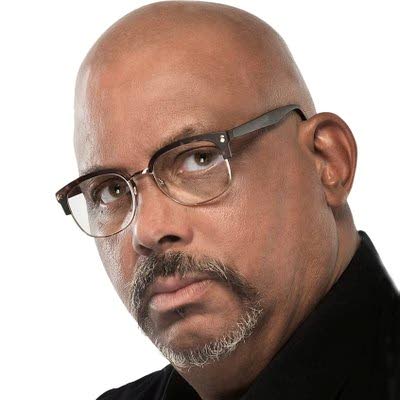

Network International Launches its Innovative Network One Payment Platform in Nigeria

L-R: Dr. Reda Helal Group, Managing Director, Processing, Africa, Network International; Mrs. Chinwe Uzoho, Regional Managing Director, West and Central Africa, Network International; Mr. Nandan Mer, Group Chief Executive Officer, Network International and Mrs. Lola Agbebiyi, Managing Director, Nigeria, Network International during the media roundtable to announce the launch of Network One Payment Platform in Nigeria on Wednesday, August 7th 2024. State-of-the-art, cloud-based, integrated digital payment suite is now on soil to serve banks, MNOs and fintechs in Nigeria and across West Africa Lagos, Nigeria, 7 August 2024. FTSE-listed Network International, a trusted payment partner of Nigerian banks, has underscored its commitment to local and regional markets by bringing its innovative award-winning digital payment platform, Network One, on soil in Nigeria. The platform is now ready to onboard and empower banks, MNOs and fintechs in Nigeria and throughout the West African region. By deploying its flagship Network One platform on soil, Network International aligns with the Central Bank of Nigeria's directive for in-country transaction routing, enhancing its local processing capabilities. The integrated platform provides banks, FIs, and fintechs with a comprehensive range of payment products and services locally in Nigeria for both issuers and acquirers. The suite is complemented by a variety of value-added services such as digital, loyalty, tokenization, enterprise fraud prevention, embedded finance and data and advisory solutions and many more. Network International is strategically investing in rolling out the platform in key markets to effectively serve its local and regional clients and partners across the MEA region. Nandan Mer, Group CEO, Network International, said: “This major milestone took us only a few months to deploy thanks to a local team that worked tirelessly and seamlessly with cross-functional colleagues in various geographies to ensure we deliver on Network One’s promise of innovation, resilience, and agility. Taking Network One live in Nigeria is integral to our company’s continued commitment to the country and the continent.” As the fourth-largest GDP in Africa with strong consumer spending, Nigeria is ripe for a digital payments boom. Total transaction value in the domestic digital payments market is projected to reach US$21.32bn in 2024, with an annual growth rate (CAGR 2024-2028) of 10.06% projected to reach a total amount of US$31.28bn by 2028 Domestic deployment good for local and African clients The Network One platform is an integrated payment suite offering both merchant and issuer solutions, hosted and supported in-country. It relies on a consolidation of best-in-class technologies brought together to provide end-to-end payment processing capabilities in a highly adaptable environment. Network International is strategically positioning its proprietary technology infrastructure, which is developed, hosted, and maintained on a local level, to cater to the needs of local and regional entities seeking market-relevant digital payment solutions for their consumers. “Our presence on the ground and comprehension of the specific needs of the local market have enabled us to tailor a solution that is ideally suited for Nigerian enterprises. Our capability to establish a hub equipped with all the essential technology not only empowers our clients to enhance their value proposition but also positions Network to effectively contribute to financial inclusion and democratization of payments, addressing the needs of a large population of consumers across the continent,” explained Dr. Reda Helal Group, MD – Processing, Africa and Co-Head Group Processing, Network International Swift growth of local talent yields significant outcomes A crucial aspect of Network International's sustained investment in Nigeria is nurturing an empowered local workforce. By growing local personnel, Network is positioned to collaborate and co-innovate with local banks and mobile network operators, providing proximity to small and medium-sized enterprises and payment experts, right in the heart of their operations. As a show of its commitment to the transformation of the local entity, the company is firming up its staff complement, and will continue to enhance its resources and talents. Network recently marked its move from level 4 BBBEE status (in July 2023) to level 1 a year later as it continues to gain trust among African institutions as a payments partner of choice. “By recruiting the right talent, we are assured that our teams in Nigeria can achieve quicker results with reduced reliance on our international teams, leading to significant operational benefits for our clients locally and regionally,” Dr. Helal added. Network International's investments throughout Africa have led to substantial improvements in economies of scale. Consequently, the company can provide state-of-the-art technology at a lower cost than what companies might incur if developed internally. This affordability, coupled with the technology's advanced features, appeals to a broad audience and furthers the company's mission to expedite digital transformation across the continent. “Network One’s successful touchdown in Nigeria embodies our ambition to establish ourselves as a company that is authentically local in the African markets we serve,” Mer concluded.

Articles similaires

SmallSmall Fair 2024: Quickteller Homes Leads Charge in Flexible Homeownership Solutions

L-R: Chukwualuka Obichukwu, Sales Manager, Quickteller Homes; Joshua Udonne, Growth Marketing Associate, Interswitch; and Obianuju Anyama, Product...

Again, MoneyMaster gets nod for Lagos food discount market

The Lagos State Government has reappointed MoneyMasterPSB, a leading payment service bank, for the second phase of the "Ounje Eko" food discount...

Introducing the newest bill payment feature on Tbay

Tbay is excited to announce the launch of Bill Payment feature to our gift card trading website in Nigeria. Tbay is a popular platform where you can...

Introducing the newest bill payment feature on Tbay

Tbay is excited to announce the launch of Bill Payment feature to our gift card trading website in Nigeria. Tbay is a popular platform where you can...

Why cash is king in Trinidad and Tobago

[audio m4a="https://newsday.co.tt/wp-content/uploads/2024/09/BitDepth1475_Narration_09-09-2024.m4a"][/audio] BitDepth#1475 Mark Lyndersay LAST MONTH...

AFRICAN UNION WRITES SOUTH AFRICA, NIGERIA AS RACE FOR AFRIMA 2025 and 2026 HOSTING RIGHTS HOTS UP

… As Morocco expresses interest Johannesburg, South Africa –South Africa may become the host of the next two editions of the All Africa...

MDP Takes Center Stage as Payments Enabler AfricaSponsor at Africa Fintech Summit Nairobi 2024

NAIROBI, Kenya, 30 August 2024/African Media Agency/- MDP, a leading payments technology provider in the Middle East and Africa, is gearing up to make...

Understanding Islamic Finance – Analysis

A bit of history Islamic finance during the time of the Prophet Muhammad was characterized by real transactions such as sale on credit and...

Understanding Islamic Finance – Analysis

A bit of history Islamic finance during the time of the Prophet Muhammad was characterized by real transactions such as sale on credit and...

Les derniers communiqués

-

Aucun élément

.jpg)

.jpg)