The accumulated volume of Chinese investments in Russia has effectively remained flat since 2022, with the only sector showing significant relative...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - ENG.UATV.UA - A La Une - Hier 15:22

Maroc - ENG.UATV.UA - A La Une - Hier 15:22

China deepens financial partnership with Russia – intelligence

Against the backdrop of a growing regional debt problem, China is increasingly using Russia as a situational economic and financial partner, UATV English reports. Ukraine's Foreign Intelligence Service stated this on its website. The debt problem of China's local authorities is rapidly worsening and is becoming one of the main systemic risks to the country's economy. Unlike the central government's sovereign debt, it is regional and municipal liabilities that are increasingly undermining China's financial stability. In 2025, municipalities' infrastructure debts amount to about CNY 60 trillion (48% of GDP), with another roughly CNY 40 trillion accounted for by direct regional debt. Servicing these obligations is increasingly carried out through new borrowing via bond issuance. The situation is further complicated by the downturn in the real estate market. For many years, up to half of local budget revenues were generated through the sale of land plots for development. The collapse in real estate demand has led to a sharp drop in land prices and a reduction in regional revenues, forcing local authorities to sink even deeper into a debt trap. At the same time, the officially reported CNY 100 trillion in debt represents only part of the real picture. There are also so-called "hidden debts", the liabilities of quasi-state infrastructure and municipal companies for which local authorities effectively act as guarantors. Estimates suggest their volume could reach another CNY 50 trillion, raising the total debt of local governments to 150 trillion CNY, or about 120% of China's GDP. In January–February 2025 alone, China's local authorities issued bonds worth CNY 1.7 trillion, or approximately $240 billion. These are unprecedented volumes, indicating a growing dependence of regions on debt financing in the short term. "China's debt problem is structurally more complex than that of the USA, as the yuan is not a fully convertible currency. This limits Beijing's ability to shift the debt burden to the outside world. In this situation, China is increasingly using Russia as an ad hoc economic and financial partner, in particular to ensure resource security, alternative payment mechanisms, and geopolitical maneuvering without taking on long-term commitments," the Foreign Intelligence Service noted. As previously reported, Russia sharply increased gold exports to China in 2025. Read also: Ukraine’s 2026 Budget Creates a $4.8B Defense Reserve: What It Means for the Front Lines The post China deepens financial partnership with Russia – intelligence appeared first on Freedom.

Articles similaires

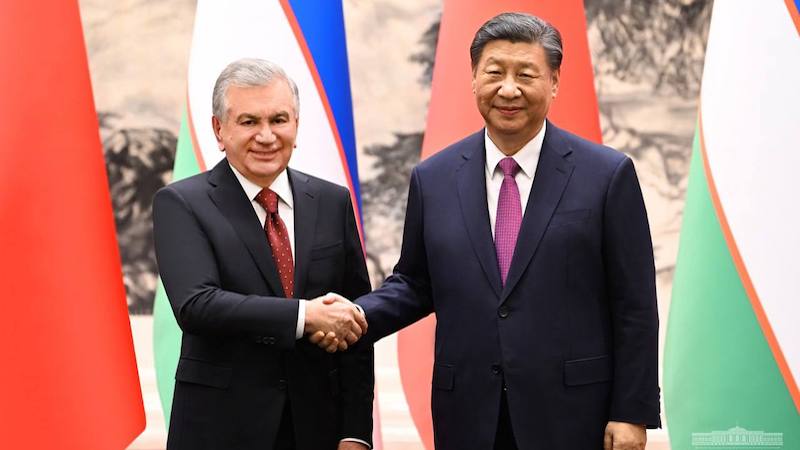

Uzbekistan: China’s New Strategic Center – OpEd

Uzbekistan pursues an exemplary multivector foreign policy and has established itself as one of the principal mediators in Central Asia. As a bridge...

Here's how Trump is tipping the world into economic chaos

America’s economic system has never been fair or perfect but for more than a century it rested on basic guardrails that kept instability in check...

Karoline Leavitt's failed campaign still drowning in $300K debt years later

White House Press Secretary Karoline Leavitt ran unsuccessfully for Congress in 2022 — and the campaign committee she set up still owes hundreds of...

Karoline Leavitt's failed campaign still drowning in $300K debt years later

White House Press Secretary Karoline Leavitt ran unsuccessfully for Congress in 2022 — and the campaign committee she set up still owes hundreds of...

Fiscal discipline strengthens as Ghana’s debt stock stands at GHC644bn

Ghana’s public debt trajectory showed further signs of stabilization in November 2025, offering cautious optimism to investors and the business...

Fiscal discipline strengthens as Ghana’s debt stock stands at GHC644bn

Ghana’s public debt trajectory showed further signs of stabilization in November 2025, offering cautious optimism to investors and the business...

India’s Rise As A Global Superpower: Why It Matters For Malaysia – Analysis

India has long been overlooked in its power strength, influence and role as the regional and global power and economic leadership equation, at the...

US National Debt Grew Slower In 2025 – OpEd

The U.S. national debt has exploded in recent years. At the end of its 2025 fiscal year, the U.S. government’s total public debt...

US National Debt Grew Slower In 2025 – OpEd

The U.S. national debt has exploded in recent years. At the end of its 2025 fiscal year, the U.S. government’s total public debt...

Les derniers communiqués

-

Aucun élément