THE Financial Intelligence Unit (FIU) has noted a huge jump in reports of suspicious financial transactions from under $2 billion worth in 2022, to...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - Aujourd'hui 07:25

Maroc - NEWSDAY.CO.TT - A la Une - Aujourd'hui 07:25

FIU warns public: Financial scams on the rise

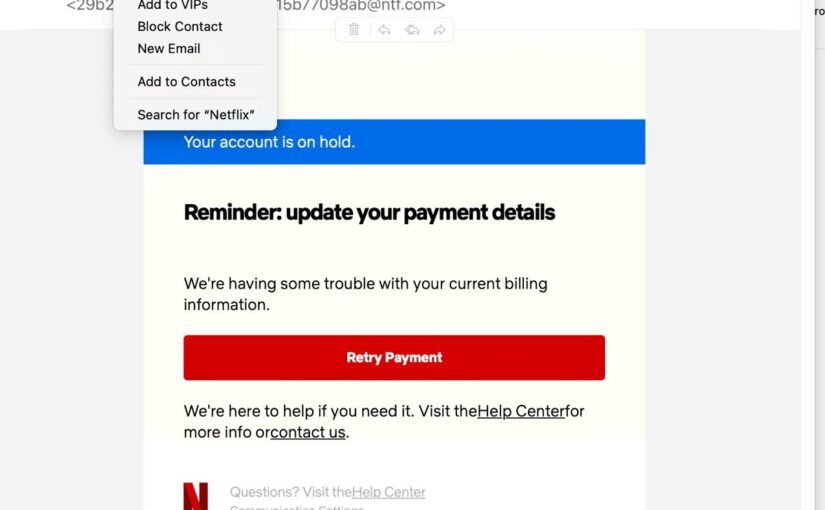

MEMBERS of the public are being warned of the prevalence of financial scams, often occurring online, in the 2024 Annual Report of the Financial Intelligence Unit (FIUTT) laid in the House of Representatives on February 5. The FIU warned about five types of scam. Kiting The first scam targets banks and financial institutions and is known as a kiting scheme, the report said. "The FIUTT has noted increased suspicious transaction reports/suspicious activity reports (STRs/SARs) wherein individual customers are benefiting from a delay in the bank’s financial management system." Prior to the fraud occurring, the accounts were funded by either cash or inter bank (IB) credits. "In most instances, these credits were followed by immediate ABM (automatic banking machine) withdrawals for the entire amount. Consequently, the accounts were left in an overdrawn state. "This pattern appears to resemble a kiting scheme, where the value of the account balances is artificially inflated, giving unauthorised access to funds." The report said a deposit is followed by a prompt withdrawal. "This initiates the float period where the funds are considered deposited but have not yet cleared." The process of deposit and withdrawal is repeated again and again at a series different banks. "This action leverages the float period, creating a cycle of artificial funds availability." It all creates "a constant state of apparent solvency, thereby taking advantage of the artificially inflated balances created by the kiting scheme." Loan fraud Secondly, the FIU warned financial institutions were also subjected to loan fraud. "The FIUTT has noted increased suspicious transaction/activity reports wherein business customers (employers) indirectly benefited from loans granted to their 'employees.’ These ‘employees’ utilised fictitious employment documentation showing an inflated income which influenced the FI's (financial institution's) lending decision. "The FIUTT continues to see this intent to defraud whereby the FI's are falling victims to loan fraud, perpetrated by business customers and their ‘employees’ or associated individuals who produce fictitious/altered job letters and/or pay slips to acquire credit facilities. In most cases, these employers’/business customers indirectly benefit from the loans granted to their ‘employees’ or associated individuals." Online investment scams Thirdly, the FIU warned of a significant rise in cases of suspected fraudulent online investment scams. "A recurring theme in impersonation schemes relating to investments is that suspected fraudsters establish creditability by purporting to receive a high return from their investment portfolio. It has even been seen where they purport to be connected to respectable, well-known companies. "These scams take-off through social media promotion such as situations where people pose as registered investment professionals and promote entry to investment platforms, via encrypted group conversations on WhatsApp and Facebook Messenger." The report gave tips to help spot the fakes. "Scammers might involve fictitious products designed to closely resemble legitimate investments. "Scammers ask victims to deposit money into their (or third parties) accounts." Social media scams Fourthly, the FIU warned of the online social media scam. "Fraudsters create websites with similar names to well-known lending businesses. Unsuspecting persons use these websites to apply for loans." The scammers ask for personal details including documentation such as job letters, payslips, identification and bank account details. "The fraudsters then inform the victim that the loan was approved. However payment of upfront fees ranging from $800-$2,000 is requested, claiming that these are necessary for application processing. "Once the victim pays the fees, the fraudsters request more fees or disappear, leaving the victim without the promised loan and out of pocket." Smishing (SMS phishing) Fifthly, the FIU warned against Smishing, a type of phishing attack using the SMS service or text messages to deceive individuals into providing sensitive information. The word is a combination of SMS and phishing. The report noted suspicious transactions within the preceding months where the victim lost sums of $3,000-$6,000. The scam starts when the victim receives a text message that seems to be from a legitimate source such as a courier, post office or bank. This message may include a link to a fake website of the organisation being impersonated or it may ask the victim to reply with personal information such as accounts details and/or passwords. The text may download malware onto the victim's device. . The report recommended how to curb this. This included to verify the source, not click on dubious links, use security software and report scams to the authorities. The post FIU warns public: Financial scams on the rise appeared first on Trinidad and Tobago Newsday.

Articles similaires

POLICE – Fraudsters impersonate RCMP online with ‘documents’ scam

Kamloops RCMP are reminding the public to be mindful of online fraudsters, following recent reports indicating an uptick in scam attempts. On Jan. 23...

Public warned about loan scams

The Cybercrime Investigation and Coordinating Center on Saturday warned the public about the proliferation of loan scams through social media and text...

What Are Scam Parks? – Analysis

By Abby Seiff Cyber scam compounds made international headlines this month after a Chinese actor was rescued from Myanmar’s notorious KK Park....

Where cybersecurity threats begin: Phishing

According to a 2021 CISCO report, most successful data breaches – more than 90 per cent – are the result of data phishing. Using information...

Court hears appeal over FIU’s request for Griffiths’ bank info

The Court of Appeal has begun hearing appeals filed by Financial Investigations Unit (FIU) director Nigel Stoddard and the Attorney General against a...

Nigerian Army Raise Alarm over Impersonation on TikTok

Safiu Kehinde The Nigerian Armed Force have raised alarm over fake TikTok accounts allegedly created by fraudsters to deceive unsuspecting Nigerians....

US federal workers facing Thursday deadline for resignation deal

by Frankie Taggart and Daniel AvisTwo million US federal workers face a deadline of Thursday to quit with a guarantee of eight months' more paid work...

Bengaluru man loses ₹70,000 to fake traffic challan scam; fraudsters exploit through WhatsApp APK File: Report

A victim in Bengaluru fell prey to a scam after downloading an unsafe app, leading to unauthorized credit card transactions.

Joint Efforts: NPF-NCCC and PSFU Secure 84 Arrests in Anti-Cybercrime Operations

In January 2025, the Nigeria Police Force National Cybercrime Centre (NPF-NCCC) successfully arrested 32 suspects, while 52 arrests were secured by...

Les derniers communiqués

-

Aucun élément