Kieran Valley-Gordon In TT, women own just 30 per cent of the approximately 20,000 registered micro, small and medium-sized enterprises (MSMEs),...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - Hier 06:47

Maroc - NEWSDAY.CO.TT - A la Une - Hier 06:47

Closing the financial divide: Strategies for women-led businesses

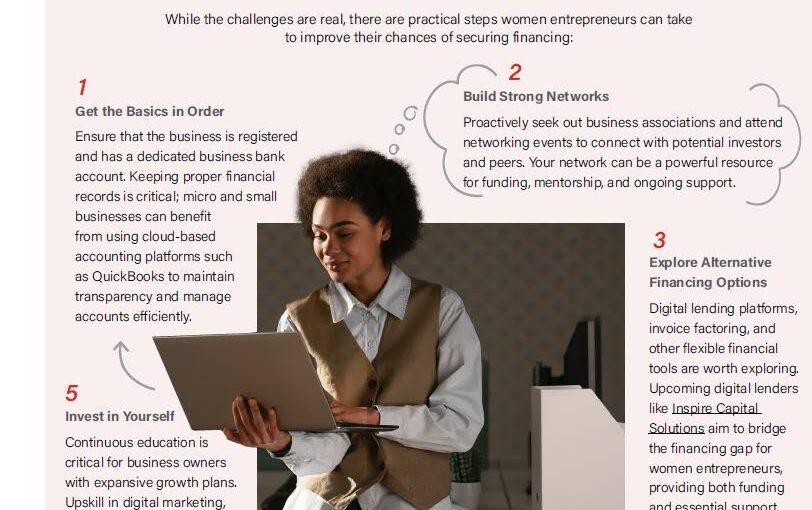

Kieran Valley-Gordon In TT, women own just 30 per cent of the approximately 20,000 registered micro, small and medium-sized enterprises (MSMEs), primarily in the micro-enterprise sector. Barriers like limited access to credit, gender biases in lending and fewer business networks restrict their growth. Research shows that boosting women’s entrepreneurship could significantly increase GDP and enhance community well-being, as women tend to reinvest in their families. Gender-intelligent financing approaches are crucial for empowering these entrepreneurs and addressing their specific challenges with tailored support. Globally, too, only one in three businesses are owned by women. According to the International Finance Corporation (IFC) MSME Finance Gap Study, only 30 per cent of MSMEs are women-owned and these businesses are disproportionately micro-enterprises. Women own 32 per cent of micro-enterprises, versus just 20 per cent of small and medium businesses. Investing in women: The catalyst for economic growth Why does this matter? When entrepreneurship among women thrives, the economy thrives. McKinsey and Company found that if women participated in the economy equally to men, global GDP could increase by US$28 trillion, or 26 per cent, over ten years compared with a "business-as-usual" scenario. Research by the IFC also shows that women entrepreneurs tend to hire more women, contributing to broader female labour force participation. Therefore, the ripple effect of encouraging women's entrepreneurship moves us closer to McKinsey’s full-parity scenario. The impact goes beyond economic growth. Studies by the Cherie Blair Foundation reveal women are more likely than men to reinvest a significant portion of their income back into their families and communities, boosting education, healthcare and overall community well-being. Women-led businesses are also more likely to focus on sustainability and long-term benefits, according to research from the Goldman Sachs 10,000 Women initiative. [caption id="attachment_1131665" align="alignnone" width="540"] Kieran Valley-Gordon, CEO and co-founder, Inspire Capital Solutions -[/caption] Supporting women entrepreneurs is good for the economy and for local communities. We recognise, of course, that entrepreneurship, male or female, is an individual choice and that factors other than access to credit, such as the disproportionate allocation of unpaid work and caring for the young and the elderly, affect women’s flexibility to participate in the labour market both as business owners and as employees. However, if we agree that there is economic and social benefit to encouraging greater participation by women in entrepreneurial activities, then providing appropriate and productive access to finance must be seen as one of the critical enablers. The case for gender-intelligent financing approaches While TT has programmes that support MSMEs, few are specifically designed for women entrepreneurs. One exception is Republic Bank’s partnership with Business and People Development Associates Ltd (BPD), which sponsors cohorts of women to participate in BPD’s Entrepreneurs Business Builder (EBB) programme. This programme helps women gain valuable skills, and, more importantly, offers access to financing. However, the traditional financing models are typically gender-blind in approach, failing to recognise the specific challenges women entrepreneurs face. Women business owners often have less access to business networks and markets, which limits their exposure to potential clients and investors. These entrepreneurs also face significant barriers in accessing credit, as traditional financing often requires high levels of collateral, which many at the micro and small stages cannot meet. Additionally, biases in lending practices – whether conscious or not – further disadvantage female entrepreneurs. [caption id="attachment_1131667" align="alignnone" width="1024"] -[/caption] That’s why gender-intelligent financing is crucial. These approaches consider women entrepreneurs' specific challenges and offer more tailored solutions. For example, offering lower collateral requirements, flexible repayment terms and programmes that provide mentorship alongside capital can increase the likelihood of success for women-led businesses. Fintech solutions, such as digital loan platforms, provide new avenues for women to access financing more efficiently. Success stories: The right support can unlock growth Nikita Legall, founder of Tropical Hives, participated in the EBB programme, during which she gained valuable skills and regional networking opportunities with fellow women entrepreneurs. This support enabled her to access funding from Republic Bank. The EBB programme helped Legall focus on growing her business instead of getting caught up managing daily operations, leading her to participate in the Youth Agricultural and Homestead programme. She recently graduated from the first cohort of that programme, securing two acres of land and $20,000 to expand her farm. Meanwhile, Crystal Joseph, founder of Aviaire Body TT, participated in the Export Action programme by Eximbank in collaboration with the TT Manufacturers’ Association (TTMA). The programme provided technical assistance and guidance in getting her business export-ready. This allowed her to expand distribution, and she now successfully offers Aviaire products worldwide. The post Closing the financial divide: Strategies for women-led businesses appeared first on Trinidad and Tobago Newsday.

Articles similaires

Latino entrepreneurs make their way in Trinidad and Tobago

Latino entrepreneurship is on the rise, with several businesses exploring the economic opportunities TT has to offer. With each passing day, more...

Latino entrepreneurs make their way in Trinidad and Tobago

Latino entrepreneurship is on the rise, with several businesses exploring the economic opportunities TT has to offer. With each passing day, more...

Growing Your Business, Your Way: AWE’s Programs and Resources for Women Entrepreneurs

(ANNews) – Alberta Women Entrepreneurs (AWE) offers growth programs and financing to support women entrepreneurs in clarifying their vision,...

Businesses call for focus on vulnerable sector for 2025

The year 2024 was a big year for economic diversification, with the manufacturing sector continuing its upward expansion and engagement through trade...

Charting the future: Vision of a resilient, productive 2025

VASHTI G GUYADEEN As 2025 begins, the TT Chamber reflects on a year of transformative progress and pragmatic optimism. Against a backdrop of global...

Tony Elumelu Foundation Opens 2025 Entrepreneurship Programmes Application

The Tony Elumelu Foundation (TEF), Africa’s leading champion of entrepreneurship, is pleased to announce that applications for its 2025...

Trini cocoa still the best

The prestige of TT’s award-winning cocoa cannot be denied, but with a decline in production over the years caused by various issues such as labour...

OJT, Sewa International TT collaborate on clothing drive

In keeping with the season of giving and in line with its mandate, Sewa International TT, a non-profit organisation, collaborated with the On-the-Job...

Introducing The Entrepreneurs Success Blueprint Programme

Lagos, Nigeria – Entrepreneurs.ng, a leading resource hub for aspiring and established entrepreneurs, proudly announces the evolution of its...

Les derniers communiqués

-

Aucun élément