BEIJING, Oct. 20 (Xinhua) -- China will intensify its support for the listing of high-quality innovative small and medium-sized enterprises (SMEs) on...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - 10/Sep 08:06

Maroc - NEWSDAY.CO.TT - A la Une - 10/Sep 08:06

Solis goes live on Trinidad and Tobago Stock Exchange

WEEKS after releasing its initial public offering (IPO), commercial print solutions company Eric Solis Marketing Ltd went live on the TT Stock Exchange (TTSE) on September 9. It became only the third business listed on the TTSE’s SME market, introduced in 2012, following CinemaOne Ltd in 2018 and Endeavour Holdings Ltd in 2019. “Today marks a significant achievement not only for Eric Solis Marketing Ltd but also for the continued growth of our SME market,” TTSE market operations manager Jase Torry told a small gathering at a ceremony at the TTSE’s offices in Nicholas Towers, Port of Spain, on the day of the launch. “With an initial public offering (IPO) of 2,750,000 shares, Eric Solis Marketing Ltd is now part of a distinguished group of companies that have realised the value of equity financing as a driver for growth and expansion,” Torry said, adding that the TTSE hopes the IPO will strengthen Solis’s market position and serve as inspire other SMEs. “The TTSE continues to recognise the invaluable role SMEs play in promoting economic growth and development. “We continue to encourage other businesses to explore the possibilities (offered by) equity financing as a viable and sustainable option for growth and development. “This is a proud moment for the TTSE as we continue our mission to support the growth of SMEs to contribute (to the) overall economic development in TT.” The IPO was opened on July 16 and closed on August 9. It was oversubscribed, attracting about 150 first-time investors on the TTSE, many of whom work at Solis and its parent company Office Authority. Torry acknowledged NCB’s role as underwriter and lead broker in facilitating the IPO. NCB Merchant Bank TT head of investments Ishan Gosine said the company worked seamlessly with the other brokers and clients to launch the IPO. “I just want to congratulate Solis on such a big (and) successful step. I think it’s a really nice blueprint for the country and for the capital markets, because we have been talking about it for a few years now, but the fiscal incentives are now in place, which I know the Stock Exchange would have lobbied (for). “And it’s really a nice time to get a listing and create momentum to get more (SMEs) listed and invigorate the capital markets.” He said the timely IPO launch was in keeping with NCB’s digital agenda. “We really want to make investing accessible to everyone, and now TTSE does that with TOP (online trading platform),” Gosine said. The TTSE established the SME market to develop the local capital market and promote economic diversification. The tier allows small and medium-sized companies, with guidance, an opportunity to raise capital on the stock market, providing an alternative financing source for capital expansion. Potential SMEs can benefit from a full tax holiday for the first five years from listing on the TTSE, exempting them from corporation tax, business levy and Green Fund levy, and access to equity financing. Additionally, brands may benefit from increased visibility, an enhanced reputation, and business transparency. They can raise capital and further funds through additional public offerings. The post Solis goes live on Trinidad and Tobago Stock Exchange appeared first on Trinidad and Tobago Newsday.

Articles similaires

Tobago business groups: SMEs feeling forex pinch

SMALL and medium-sized enterprises (SMEs) in Tobago are being gravely affected by the shortage of foreign exchange in the country, says Tobago...

Toni Sirju-Ramnarine newest director at Agostini’s Ltd

TONI SIRJU-RAMNARINE has been appointed to the board of directors of Agostini’s Ltd. A notice on the Trinidad and Tobago Stock Exchange's website...

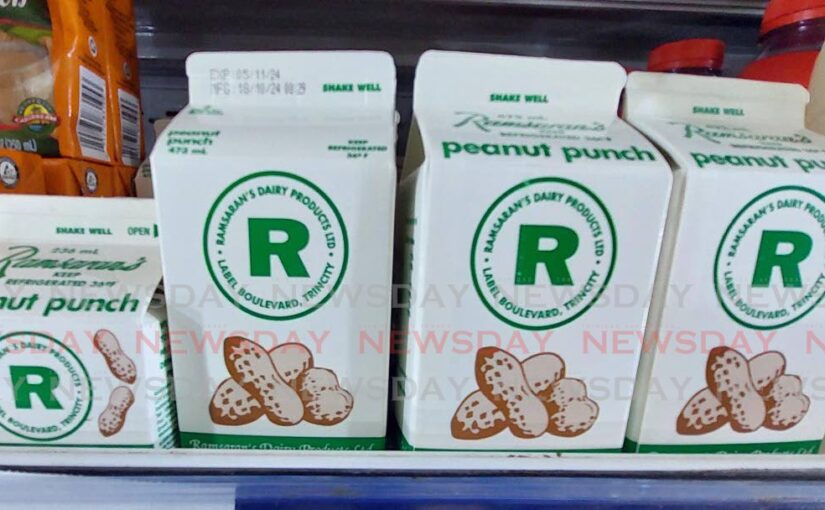

Ramsaran writes to Kamla for help on forex distribution issue

BEVERAGE producer Rajnanan Ramsaran has now appealed for parliamentary intervention and public advocacy on the foreign exchange (forex) distribution...

COIN Stock Trading at a Premium to Industry at 96.60X: Should You Buy?

Coinbase's efforts to accelerate growth, increase market share and continue innovation poise it well for growth, but its weak return on capital keeps...

Ramsaran Dairy founder complains to Central Bank, IMF, Auditor General on forex challenges

A local manufacturer has written to the Central Bank governor, the Auditor General, and the International Monetary Fund (IMF) complaining about the...

Moniepoint secures US$110m funding to scale digital payments and banking solutions

Africa’s fastest-growing financial institution, Moniepoint Inc has successfully raised US$110 million in equity financing, to power the dreams of...

Reasons to Add Leidos Stock to Your Portfolio Right Now

LDOS makes a strong case for investment in the Aerospace sector, given its solid earnings growth prospects, return on equity and rising backlog.

Swiggy trims valuation target to $11.3 billion for IPO

Swiggy plans a Rs 11,327 crore IPO on Nov 6, aiming for $11.3 billion valuation, adjusted from up to $13 billion due to market conditions. Prosus,...

Why Has The Indian Stock Market Experienced A Long-Term Upward Trend? – Analysis

By Xia Ri The rise of the Indian stock market is a long-term process. From the early 1990s to the early 2000s, the Indian stock market gradually...

Les derniers communiqués

-

Aucun élément