IN a unanimous ruling, the London-based Privy Council has dismissed a challenge by the Public Services Association (PSA) of the ongoing...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - 16/Sep 17:55

Maroc - NEWSDAY.CO.TT - A la Une - 16/Sep 17:55

Imbert celebrates victory as Privy Council rules Revenue Authority lawful

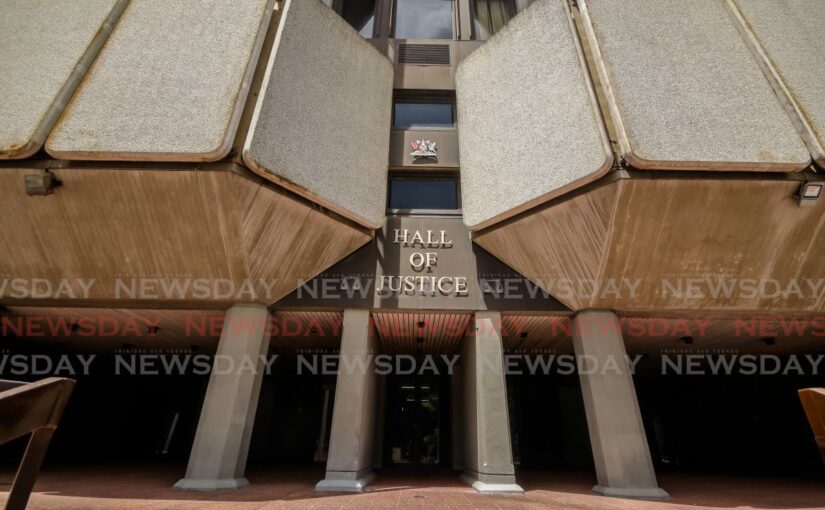

GOVERNMENT’s Revenue Authority Act is constitutional, the London-based Privy Council has unanimously ruled. The Public Services Association (PSA), through its member, customs officer Terissa Dhoray, challenged the constitutionality of the legislation and the operationalisation of the Revenue Authority (TTRA). The five law lords who presided over the appeal of customs officer Terissa Dhoray were expected to deliver their decision at the beginning of October. However, in a written ruling on September 16, they “unanimously dismissed the appellant’s appeal.” Finance Minister Colm Imbert posted on X, just before 7 am, saying, “The Privy Council just published its decision in the constitutional challenge to the Trinidad and Tobago Revenue Authority. WE WON THE CASE! This required tremendous effort against the relentless opposition from the UNC and the PSA. “Now we can modernise revenue collection in TT!” On May 28, Justices of Appeal Nolan Bereaux, Pemberton and Dean-Armorer dismissed the challenge, which High Court judge Westmin James initially rejected in November 2023. The Appeal Court’s unanimous decision gave the Government the green light to proceed to implement the TTRA. After the Appeal Court’s ruling, the Prime Minister said he instructed Imbert to proceed with plans to fully establish the authority. However, Dhoray and the PSA took their legal challenge to the Privy Council. In her lawsuit, Dhoray challenged the constitutional validity of the Revenue Act 2021. Her attorneys, led by Anand Ramlogan, SC, contended section 18 of the act sought to interfere with the terms and conditions of employment of public servants currently assigned to the CED and Inland Revenue Division (IRD). The section gave public servants – some 1,200 – three months to decide on their future employment on the operationalisation of the TTRA. Those affected had the choice to resign from the public service, accept a transfer to the TTRA or be transferred to another office in the public service. Dhoray also claimed the Government did not have the power to delegate its tax-revenue-collection duties. The initial deadline for BIR and CED employees to choose one of the options given to them was July 31, 2023. There were at least five other extensions, with the last being July 31, 2024. At an expedited hearing in July, the Privy Council declined to grant a stay of a decision by the Ministry of Finance to request that workers give their decision by the end of the month. In June, some 249 public servants had already exercised their options to transfer to the authority while there were 863 vacant posts to be filled. In August, the PSA complained of a lack of information from the ministry and the TTRA on compensation and the voluntary separation package. The PSA met with Chief Personnel Officer Dr Daryl Dindial in August. In its ruling in May, the Court of Appeal held that the functions of assessment and collection were not core functions and there was no constitutional infringement in their being delegated to the Revenue Authority. In his ruling, James ruled that tax collection was not a core governmental function. He said the TTRA was “meant to be a semi-autonomous revenue authority.” [caption id="attachment_1108846" align="alignnone" width="1024"] The Inland Revenue Division (IRD), Port of Spain. The IRD and Customs and Excise Division will be merged as the Trinidad and Tobago Revenue Authority. - File photo by Gabriel Williams[/caption] In their ruling, Lords Reed, Lloyd-Jones, Burrows, Stephens, and Lady Simler held that the TTRA Act did not breach the Constitution. Although they agreed with the local court’s findings, they did so for different reasons. Lady Simler delivered the ruling, She held there was nothing in the Constitution that expressly prohibited the transfer of tax-collection duties to the TTRA. “No matter how wide or narrow the concept of government function might be (core or otherwise), the fact that there is a Public (Police or Teaching) Service Commission does not mean that every government function or service (for example, the provision of water, sewerage or electricity) must be provided by public officers… “...There is no express provision of the Constitution or any assumption on which it is based that requires the assessment and collection of tax to be carried out only by persons directly employed in the service of government.” Lady Simler also held that since section 9 of the Constitution was meant to protect public officers and the public from improper political pressure, any separate statutory body had to be “genuinely independent and not a device or a sham,” and there must be adequate and effective safeguards for workers to protect them from political interference by the executive. “In this case, both conditions are met. There is nothing to suggest that the authority is a device or a sham, and such a suggestion has not formed any part of the appellant’s case.” Lady Simler said there were safeguards to prevent either the board or the minister from playing any part in the day to day operations o the authority. She also noted the board was prohibited from accessing any information about individuals or entities or documents collected or any documents concerning legal action by or against the authority to enforce revenue laws. “Moreover, the minister may only give general policy directions to the board in relation to the board’s own functions (section 8(3)) and is given no statutory authority to give directions to the authority.” She further noted that TTRA employees, in particular the director general and deputy directors general, had protections that gave them security of employment and insulated them from improper interference from the executive. “All other staff of the authority enjoy all the rights of employees in the private sector.” Their avenues for remedy include provisions of the Industrial Relations Act and private law contractual rights. She said any action by the board or the minister considered to “pressurise staff to act in a way that would advance the interests of a rival political party or faction of government” would be susceptible to legal challenge. Taxpayers also had avenues of redress if they felt the TTRA’s powers were being misused and they were forced to pay a tax not due under law before the Tax Appeal Board and then the Court of Appeal. “For all these reasons the Board is satisfied that there are the necessary mechanisms and effective safeguards to protect the staff and officers of the Authority and members of the public from executive interference. “Accordingly, the act is not inconsistent with the Constitution.” Two additional arguments on a prohibition against the abolition of posts in the public service by the Parliament, raised by Ramlogan for the PSA, were also rejected by the Privy Council. “This appeal concerns the removal of public offices from the public service and not the removal of public officers from offices which vest in the Public Service Commission. “...The establishment of the authority does not alter, in any way, the entrenched provisions of the Constitution. Lady Simler added, “The Constitution requires that the obligation to pay tax is imposed by law and further requires that all monies collected by way of taxation be deposited into the Exchequer Fund and that payment out be authorised by Parliament. “The act is consistent with these requirements.” The Revenue Authority Act, 2021, was passed in Parliament by a simple majority and was assented to in December 2021. President Christine Kangaloo proclaimed section 18 of the legislation on April 24, 2023. The current TTRA board was appointed in June 2022. The chairman and vice-chairman’s terms are for five years and other members, except for the permanent secretary, are there for three years. In April, the Parliament approved three nominations for the TTRA’s director general, and two deputy directors general for domestic tax and customs and excise. Also representing Dhoray and the PSA were Robert Strang, and Katherine Bailey while Douglas Mendes, SC, and Michael de la Bastide, SC, represented the State. The post Imbert celebrates victory as Privy Council rules Revenue Authority lawful appeared first on Trinidad and Tobago Newsday.

Articles similaires

Baptiste: IRD, Customs staff still in dark over Revenue Authority

PUBLIC Services Association (PSA) head Leroy Baptiste said the Privy Council's nod for the TT Revenue Authority (TTRA) sheds no light on the possible...

Watershed TTRA ruling

IN ADJUDGING the Revenue Authority (TTRA) constitutional, the Privy Council has handed the Government a significant victory with consequences well...

Kamla: PNM seeking $$ for election

OPPOSITION Leader Kamla Persad-Bissessar has said the PNM is looking to extract money from citizens to fund its general-election campaign. She made...

Saddam chides Imbert over new tax law

SADDAM HOSEIN, Barataria/San Juan MP, accused Finance Minister Colm Imbert of replacing the Board of Inland Revenue (BIR) with his own office as...

Saddam chides Imbert over new tax law

SADDAM HOSEIN, Barataria/San Juan MP, accused Finance Minister Colm Imbert of replacing the Board of Inland Revenue (BIR) with his own office as...

Trinidad gets the ‘go ahead’ from Privy Council on revenue authority:

(Trinidad Express) “We won the case!” So gushed a joyful Finance Minister Colm Imbert who was yesterday given the green light by the Privy Council...

Imbert: New ways to pay property tax in the works

FINANCE Minister Colm Imbert says solutions are being worked on to address the challenges people are experiencing in paying their residential...

SKMM / MCMC Share More Regarding DNS Redirection Implementation

One of the things that became a hot conversation for a day or two was related to the implementation of DNS redirection by internet service providers...

Correcting the record

TERRENCE W FARRELL IN A RECENT article (Politics and judicial discord, Guardian, August 30) Dr Varma Deyalsingh, among other things, asserted: “In...

Les derniers communiqués

-

Aucun élément