Dear Editor, The U.S. Foreign Tax Credit (FTC) is designed to prevent double taxation by allowing individuals and corporations to offset taxes paid to...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - KAIETEURNEWSONLINE.COM - A la Une - 16/Feb 18:22

Maroc - KAIETEURNEWSONLINE.COM - A la Une - 16/Feb 18:22

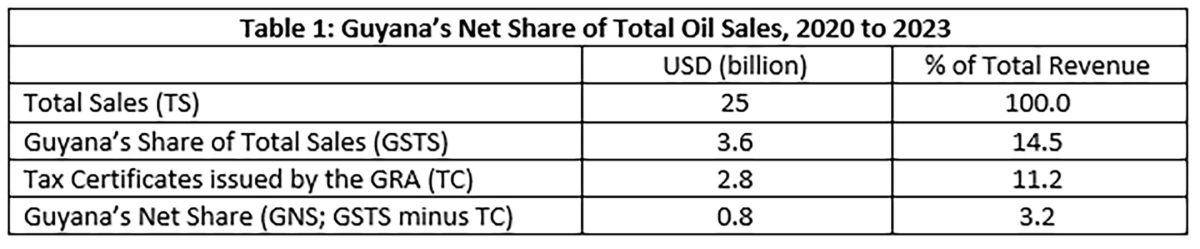

Is ExxonMobil depriving the US Treasury of Tax Revenues?

Dear Editor The U.S. Foreign Tax Credit (FTC) is designed to prevent double taxation by allowing individuals and corporations to offset taxes paid to foreign governments against their U.S. tax obligations. However, there is compelling evidence that ExxonMobil and its affiliates obtain tax certificates issued by the Guyana Revenue Authority (GRA) without actually paying taxes […]

Articles similaires

Despite not paying taxes, Exxon boss says profit sharing and royalty is same as giving Guyana tax

“In effect, that profit sharing royalty is tax…so would you prefer to have 25% income tax or 52% plus of revenues effective tax to the state from...

US Government’s Excessive Spending Scandal Grows Bigger – OpEd

Members of the Biden-Harris administration went on a massive spending bender during their final four months in office. By that, I mean they...

Foreign Companies Driving The Global Privatization Of Domestic Infrastructure – Analysis

Foreign entities have secured profitable positions in once-public domestic infrastructure. The pursuit of short-term cash has sacrificed long-term...

Donald Trump’s Tariffs: Bad Economics And Maybe Illegal, Too – OpEd

Amid the flurry of unconstitutional or illegal executive orders from President Donald Trump—for example, the freezing of congressionally approved...

Oil contract: the taxation article

Dear Editor Article 15, otherwise known as the Taxation Article, is 4-pages long and is part of the 114-page PSA (Production Sharing Agreement),...

Lincoln Electric Q4 Earnings Top Estimates, Revenues Dip 3% Y/Y

LECO's Q4 top line reflects the impacts of a decrease in organic sales and unfavorable foreign exchange, partially offset by acquisitions.

GRA and Team Mohameds at odds over taxes

Kaieteur News- The Guyana Revenue Authority (GRA) on Thursday accused Team Mohamed of understating the value of three imported vehicles, including a...

‘Wilful acts of bastardry’: former Treasury secretary says young Australian workers ‘robbed’ by tax system

Ken Henry made comments at a tax summit in Melbourne, arguing fiscal drag is seeing taxes go up while real incomes fall

‘Wilful act of bastardry’: Henry condemns tax system for crushing young Australians

Former Treasury boss Ken Henry says a succession of governments have used the tax system to deliberately hurt young people, propping up the old and...

Les derniers communiqués

-

Aucun élément