Editor’s Note: A previous version of this article stated that Jones Lang Lasalle Real Estate Services, Inc. (JLL) has been proposed to broker the...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Maroc - STOREYS.COM - A La Une - 04/Jul 14:50

Maroc - STOREYS.COM - A La Une - 04/Jul 14:50

JJL Proposed To Broker Sale Of Mississauga Industrial Development Sites In Receivership

It’s been just over a month since a cluster of industrial development sites in the Southdown neighbourhood of Mississauga were hit with a receivership order from the Ontario courts. And the grounds for doing so were quite strong; according to court filings, the site owners were some $60M over-budget and owning more than $363M at the time the pleas for receivership were made. The proceedings continue to move along according to a court document from June 18, 2024, which states that KSV Advisory — the appointed receiver and manager of the properties at 759 Winston Churchill Boulevard, 688 Southdown Road, and 2226 Royal Windsor Drive — is petitioning for a “Sale Process Approval Order” from the courts. In addition, KSV is seeking permissions to bring on Jones Lang Lasalle Real Estate Services, Inc. (JLL) specifically to broker the sale of the property on an “as is, where is” basis. The KSV’s filings additionally explain that they “did not conduct a request for proposal from several realtors as the cost of doing so would not have been economical in the context of the size of the KingSett indebtedness” (KingSett being the primary lender).“The receiver submits that the proposed Sale Process Approval Order is the next logical step in these receivership proceedings and is in the best interest of the company’s stakeholders,” the June 18 documents reads. “If granted, the relief proposed under the Sale Process Approval Order will allow for a flexible, efficient and competitive process for canvassing the market for potential buyers of the Real Property. The proposed relief is supported by KingSett.”The Development; The Receivership The industrial and residential undertaking at the addresses of 759 Winston Churchill Boulevard, 688 Southdown Road, and 2226 Royal Windsor Drive have been mired in receivership proceedings since KingSett Capital filed an application in mid-February. The courts granted the receivership order several months later, on May 30, appointing KSV receiver and manager of the properties, assets, and undertakings over three single-purpose and privately held real estate companies known as 759 Winston Churchill GP Inc., 688 Southdown GP Inc., and 2226 Royal Windsor GP Inc.Collectively referred to as the “debtors” throughout the court documents, those three entities are the registered owners of the aforementioned development sites in southwest Mississauga. Michael Moldenhauer — he appears to be at the head of a Toronto-based real estate, investment, development and finance company known as the Moldenhauer Corporation — is described as “a director of each of the debtors.”A sworn affidavit from Daniel Pollack, dated April 23, runs through the events that led up to the receivership appointment. Pollack, who is Executive Director of Portfolio Management over at KingSett, explains that the development was set to include a series of complexes both industrial and residential in nature.Speaking specifically to the 759 Winston Churchill property: it was “intended to be developed into 750,354 sq. ft of industrial facilities, comprised of three Class A industrial buildings.” At the time of Pollack’s affidavit, just one building had been completed, and was fully-leased. Another was under construction and the third had not yet broken ground — but even so, “the costs associated with the Churchill Lands have gone approximately $60M over-budget.” Rendering of warehouse at 759 Winston Churchill Boulevard, which Pollack's affidavit describes as completed and fully-leased. (Avison Young/realtor.ca)As for the two other addresses included in the court documents — 91 acres on Southdown and 74.5 acres on Royal Windsor — it appears that they are currently zoned for industrial use but were planned to be rezoned for residential. The status of the rezoning was reportedly “unclear” to KingSett when they initiated the receivership proceedings, and the court documents state that no material construction had commenced on either site to date.Pollack’s affidavit says that loan facilities extended by KingSett to the debtors in support of acquisition, refinancing, and development include a loan to in the principal amount of $205M and cash in lieu of letters of credit in the principal amount of $7,653,864 — both extended to the Churchill site owner — as well as a $165M loan to the Southdown owner and a $35M loan to the Royal Windsor owner.In the time that has elapsed since the initial loans were issued, KingSett alleges “several events of default” under the lending agreement, including Churchill’s failure to pay the monthly payments of interest, the registration of construction liens against the Churchill lands in the amount of $3,755,712, Southdown’s failure to pay indebtedness owing in full by the maturity date, and the registration of construction liens against the Southdown lands in the amount of $13,522,685.As of January 2024, $328,327,905 was outstanding in respect of Churchill and Southdown, while an additional $35,252,643 was outstanding for Royal Windsor. Taken together, the development property is now linked to $363,580,548 in total debt.Though demand letters have been issued from KingSett to the debtors, “the entirety of the Indebtedness remains outstanding and the Debtors have failed to table any viable solution,” according to the court documents.

Articles similaires

Receiver Appointed Over Brampton, Caledon Development Lands As Lenders Allege $90M Debt

As we’re seeing more and more across Ontario — and across Canada, for that matter — development land is highly prone to falling into distress....

Contractor Chosen To Complete Vandyk Lakeview DXE Club Project Under Receivership

In a somewhat surprising — but not completely unexpected — turn of events, the Lakeview DXE Club project by Vandyk Properties will be brought to...

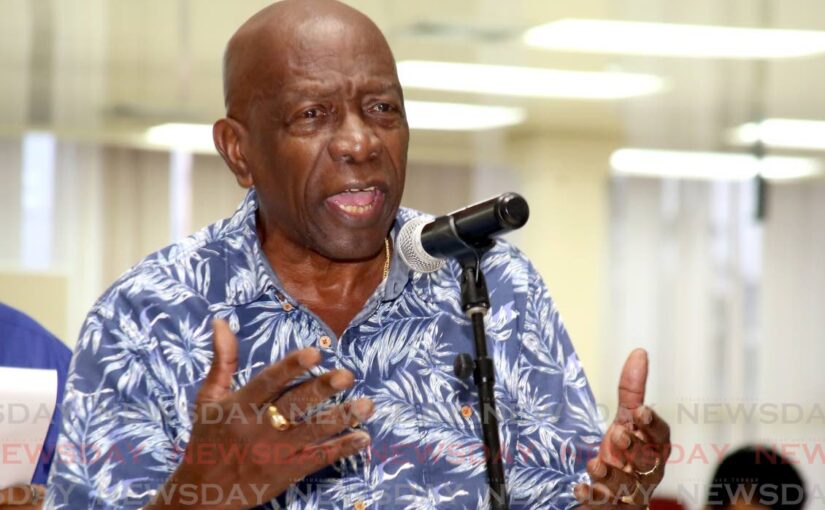

Warner’s extradition legal fees case likely to go to trial in 2025

FORMER FIFA vice president Jack Warner’s challenge against the permanent secretary of the Office of the Attorney General for failing to disclose...

Spotlight Developments' Kitchener Residential Project Owing $20M Placed Under Receivership

According to filings in the Ontario Superior Court of Justice, another residential development has been placed under receivership. The vacant...

Stanley District Project By La Pue International Sold Via Receivership

A 2.71-acre parcel of land in Niagara Falls formerly owned by La Pue International Inc. was recently sold to Lakeshore Luxe Design & Build Group after...

Why Development Land Is The Most Common Asset To Fall Into Distress

Across Ontario, development projects are being placed under receivership seemingly every week, and while each case has its own unique circumstances,...

Airport Parkway property acquired for additional industrial land

More industrial land will be made available in the City of Belleville. The property at 175 Airport Parkway was recommended to be acquired by the city...

Airport Parkway property acquired for additional industrial land

More industrial land will be made available in the City of Belleville. The property at 175 Airport Parkway was recommended to be acquired by the city...

Industrial court president: Court not biased toward unions

PRESIDENT of the Industrial Court Heather Seale says contrary to perceptions, the court is not biased towards unions and employees. She made the...

Les derniers communiqués

-

Four Seasons to Expand Saudi Arabian Portfolio Alongside Dar Al Omran Company with New Hotel in Madinah

Four Seasons Hotels and Resorts - 07/05/2024

-

Four Seasons Yachts Unveils Inaugural Itineraries to the Caribbean and Mediterranean and a First Look at its 95 Spectacular Suites

Four Seasons Hotels and Resorts - 27/03/2024

-

Visual 01Elevating Excellence: Four Seasons Embarks on the Next Stage of Strategic Global Growth

Four Seasons Hotels and Resorts - 22/01/2024