Against the backdrop of a growing regional debt problem, China is increasingly using Russia as a situational economic and financial partner, UATV...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - EURASIAREVIEW.COM - A la une - 30/06/2024 00:39

Maroc - EURASIAREVIEW.COM - A la une - 30/06/2024 00:39

China’s Economic Conundrum Under Xi Jinping – Analysis

By Seong-hyon Lee China’s economic predicament is rooted in a struggling real estate sector and a strategy predicated on a shift towards high-tech industries. President Xi Jinping’s prioritisation of national security and scepticism of market forces is exacerbating the problem and leading to tensions between political will and economic imperatives. China’s troubled real estate sector once accounted for an impressive;30 per cent;of national GDP. Its;peak in 2018;gave way to a sharp downturn — which, further aggravated by the COVID-19 pandemic, today functions at approximately;half of its former capacity.;This decline has left a big mark on China’s economic fabric, with property sales;plummeting by 20.5 per cent;in the first two months of 2024. Historically, real estate was not just a financial powerhouse but also a catalyst for ancillary sectors, driving employment in construction, stimulating retail development and boosting banking through loans. This relationship fostered a dynamic cycle of economic expansion. But as China transitions towards a middle class society, Xi’s administration is steering away from this growth model. The government’s ‘Three Red Lines’ policy — designed to mitigate substantial risks among the many property developers with mounting debt — was a lukewarm response that led to reduced residential investment. The policy indicates Xi’s pivot towards more technologically advanced industries,;such as AI, big data, bioengineering, semiconductors and quantum computing. This shift fits into a broader agenda to reposition the Chinese economy towards high-tech industries, mirroring global economic trends that favour scientific innovation and smart technology. Most importantly, it aims to secure a win in the US–China rivalry. Xi’s;prioritisation of national security;over economic flexibility complicates this transition. His deep-seated scepticism of market forces, shaped by the experience of;corruption and ideological deviations;during former president Hu Jintao’s administration, continues to influence economic policy. His cautious approach has placed increased scrutiny and;limitations on major tech firms, reflecting a strategy of;economic statecraft;that favours firm state control over market-driven growth. The government’s;preference for bolstering state-owned enterprises;at the expense of the private sector — which has been a cradle of innovation and economic vitality — is a decisive political stance. But bureaucratic state-owned enterprises cannot yield the same successes as a thriving entrepreneurial sector when it comes to innovating in cutting-edge technology. Xi’s approach dampens entrepreneurial spirit and curbs the private sector’s capacity to innovate and compete globally. Already there has been a noticeable shift in career aspirations among the young, who now;gravitate towards government jobs;in search of stability rather than pursuing entrepreneurship. Despite;5.3 per cent GDP growth;in the first quarter of 2024, the International Monetary Fund suggests that China’s economic rebound could take several years and become;a medium-term slowdown. The;once robust manufacturing sector;— though showing signs of revival — cannot fully offset the substantial downturn in real estate. While China excels in producing solar panels, wind energy and electric vehicles, its success is drawing unwanted attention from Western competition policy analysts and attracting import restrictions. Consequently, China risks developing manufacturing bottlenecks. Meanwhile, consumer confidence;remains subdued. Retail sales growth slowed to;2.3 per centyear-on-year in April 2024, a drop from 3.1 per cent in March. This deceleration in consumer spending underscores the economic uncertainties and the persistent negative wealth effects stemming from the real estate market downturn. The government faces a dilemma. It must reignite growth without reverting to outdated methods that won’t solve the nation’s problems today. Yet Xi is so determined to keep political control that he is stifling entrepreneurship. Hence, the challenge lies not only in supporting Xi’s new economic prescription — ‘new productive forces’ — which is independent of the real estate sector but also in implementing it swiftly enough to yield results. This is crucial to ensure a V-shaped recovery and prevent a recession. This scenario is a significant test for Xi’s ideological framework, which champions a Marxist-socialist model over Western capitalist paradigms. Xi’s push for ‘common prosperity’ seeks to alleviate income inequalities aggravated by decades of disparate economic growth. Former Chinese leader Deng Xiaoping permitted this disparity to optimise economic reform and opening-up. Xi’s focus on income equality and regional equity marks a pivotal shift back to state-led initiatives. Some analysts in;both China;and;the United States;argue that China’s economic situation is not as dire as is sometimes suggested. But while the Chinese government announced several measures to stabilise the property sector in May 2024, the lack of precedents for China’s stance raises doubts about its feasibility under current policy strategies. For Xi, implementing these policies will require a balance of political fortitude and economic acumen that is historically rare. The intertwining of governance, ideology and market dynamics under Xi presents a landscape where political decisions profoundly influence economic outcomes. The challenge lies in executing a balanced strategy that fosters economic vitality while adhering to ideological commitments. China, renowned for its economic resilience, faces a narrowing window of opportunity to recover from its significant economic setbacks. China must regain momentum before it misses its opportunity for economic rejuvenation. About the author: Dr Seong-Hyon Lee is Visiting Scholar at the Harvard University Asia Center and Senior Fellow at the George H. W. Bush Foundation for U.S.–China Relations. Source: This article was published by East Asia Forum

Articles similaires

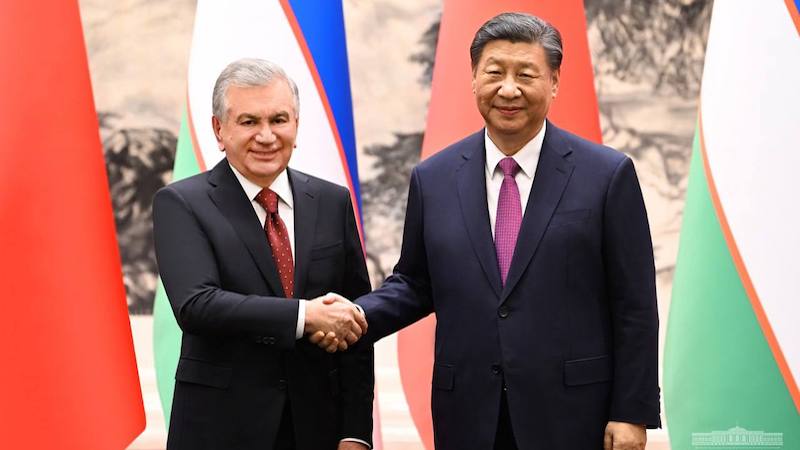

Uzbekistan: China’s New Strategic Center – OpEd

Uzbekistan pursues an exemplary multivector foreign policy and has established itself as one of the principal mediators in Central Asia. As a bridge...

China expands imports, shares growth globally

China's drive to expand imports is emerging as a crucial feature of its high-level opening-up strategy, underscoring Beijing's commitment to sharing...

Financial Security (FinSec) Series with Dr Philip Takyi: China’s export model is breaking: Africa is ...

For more than two decades, China’s economic ascent has been one of the defining forces of the global economy. Its investment-heavy growth model,...

Effects Of Export Diversification Under US Tariffs – Analysis

By Zhou Chao The year 2025 marks a significant turning point in the structure of U.S. foreign trade, with one of the main driving forces being a...

Takaichi’s Victory: Japan Embraces Stability At Home, Proactiveness Abroad – Analysis

By Pratnashree Basu Prime Minister Sanae Takaichi’s landslide victory with a two-thirds majority in the 08 February snap general election marks a...

One Battle After Another: Factional Struggles And The Making Of Trump’s Foreign Policy – Analysis

By Majda Ruge Participation prize “Considering your Country decided not to give me the Nobel Peace Prize for having stopped 8 Wars PLUS,...

Bangladesh After The Ballot: Change, Anxiety And The Return Of Old Forces – OpEd

The result of Bangladesh’s parliamentary election surprised few observers who had followed the country’s turbulent politics over the past two...

South Africa’s Minister Tau Leads Delegation To China For Key Trade Talks

By Themba Thobela South Africa’s Minister of Trade, Industry and Competition, Parks Tau, is leading a high-level delegation to Beijing, China,...

The U.S.–India Trade Reset Is Really A Bet On Geoeconomic Alignment – Analysis

The United States and India have agreed on a framework for an Interim Trade Agreement aimed at establishing reciprocal and mutually beneficial...

Les derniers communiqués

-

Meta begins construction of $10-billion data centre in Indiana

Meta - 12/02/2026

-

Google brings more Gemini AI features to Chrome browser

GOOGLE - 02/02/2026

-

GM Canada at the 2026 Montreal International Auto Show

General Motors - 15/01/2026

-

Bank of America Reports Fourth Quarter 2025 Financial Results

Bank of America - 15/01/2026

-

organ Stanley Capital Partners Makes Majority Investment in Olsson, Inc.

Morgan stanley - 13/01/2026

-

Cadillac Formula 1® Team Unveils Special Edition Livery for Barcelona Shakedown

General Motors - 13/01/2026

-

confidence with new 12-month/12,000 mile warranty

General Motors - 13/01/2026

-

Siemens named a leader in Green Quadrant: Quality Management Software 2025 report

SIEMENS - 12/01/2026

-

American rings in the new year with non-alcoholic IPA, new cocktails and refreshed menus in ight

AMERICAN AIRLINES - 12/01/2026

-

American Airlines partners with award-winning Pecan Lodge to serve Texas barbecue on select flights from DFW to New York airports

AMERICAN AIRLINES - 09/01/2026