The Pakistan Stock Exchange (PSX) witnessed bullish sentiments throughout the week ended on October 25, 2024. The benchmark KSE-100 index recorded...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - EURASIAREVIEW.COM - A la une - 10/Aug 15:46

Maroc - EURASIAREVIEW.COM - A la une - 10/Aug 15:46

Pakistan Stock Exchange Posts Nominal Gains – OpEd

The Pakistan Stock Exchange witnessed mixed momentum throughout the week ended on August 09, 2024 to close at 78,570 level with a nominal 0.4%WoW gain. According to a report by AKD Securities, the week began on a turbulent note, primarily due to concerns about global markets following Japan’s interest rate hike. However, a rebound in the E&P sector, spurred by a surprising payout from MARI, revitalizing market sentiment in the last two sessions. Investors’ confidence was further strengthened by debt rollover commitments during the week, aligning with IMF prerequisites ahead of the Executive Board meeting expected later this month. Additionally, T-Bill yields dropped in the latest auction on Wednesday, signaling investor anticipation of rapid rate cuts in upcoming Monetary Policy Committee (MPC) meetings. This decline in T-Bill yields consequently led to KIBOR rates hitting 18-month low. On the macroeconomic front, remittances for July 2024 were reported at US$3.0 billion, up 45%YoY, cementing a positive outlook for the current account balance for the ongoing year. The energy sector remained a focal point of public discourse amid rising power prices, prompting the government to establish a task force on energy and announce plans to retire/ gradually phase out 15 IPPs. The ECC directed the relevant ministry to formulate a fertilizer policy to address concerns over production, pricing, and the provision of gas, which might result in unify gas prices across the industry. Despite initial volatility in market, participation surged by 38%WoW, with the average daily traded volume rising to 493 million shares, from 358 million shares a week ago. On the currency front, PKR largely remained stable against the greenback, closing the week at PKR278.55 to a US$. Other major news flows during the week included: 1) Cement sales declined by 7% due to slow down of economic activity, 2) SBP forex reserves rose by US$51 million to US$9.15 billion, 3) SIFC was hopeful of foreign investments once IMF deal was done, and 4) GoP hiked GST on tractors to 14%. Woollen, Textile weaving, and Textile spinning were amongst the top performing sectors, while, Vanaspati & allied industries, Property, and Fertilizer were amongst the worst performers. Major net selling was recorded by Mutual Funds with a net sell of US$6.0 million. Individuals absorbed most of the selling with a net buy of US$5.5 million. Top performing scrips of the week were: YOUW, BNWM, MARI, SNGP and APL, while top laggards included: PIBTL, AKBL, BAHL, FFC and ATRL Looking ahead, market is expected to continue positive momentum as global market concerns settle and macroeconomic indicators remain favorable. The anticipated IMF Executive Board approval during the month is likely to support the momentum. Sectors benefiting from monetary easing and structural reforms would remain in the limelight. However, modest economic recovery would keep the upside in check for the cyclicals.

Articles similaires

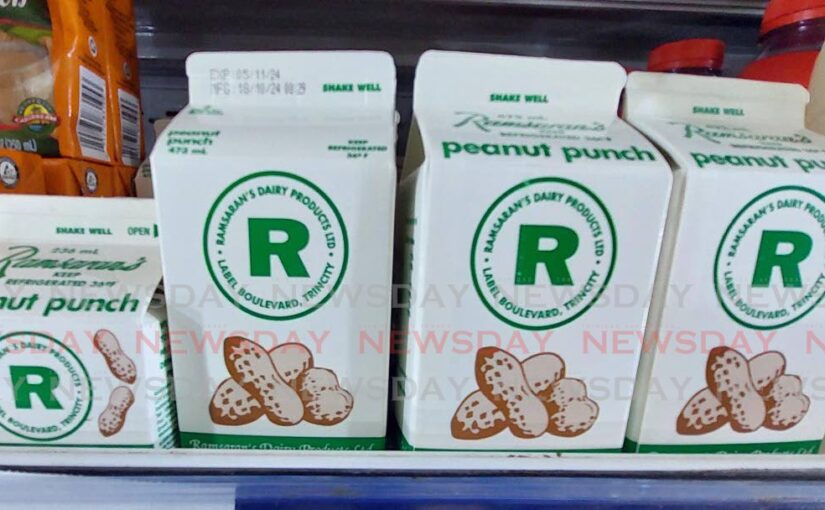

Ramsaran Dairy founder complains to Central Bank, IMF, Auditor General on forex challenges

A local manufacturer has written to the Central Bank governor, the Auditor General, and the International Monetary Fund (IMF) complaining about the...

Luxury Homebuyers Set For "Most Favourable Conditions In Years"

Canada's luxury real estate market remained steady in the third quarter with slight gains in a number of key markets, according to Sotheby’s...

US soybean net sales up 6% to 2.27 mln tonnes; exports unchanged

US weekly soybean net sales for the 2024/25 crop year rose by 6% in the week to October 24, to 2.27 million tonnes from 2.1 million tonnes million...

Emerging markets cap a turbulent month with losses before US vote

EMERGING-MARKET assets wrapped up a turbulent month as volatility surged in October with rising global yields, a stronger dollar, and investors...

US weekly corn inspections fall 18%, within market estimates

Export inspections of US corn were down by 18% to 823,664 tonnes during the week to Thursday October 24, from 1 million tonnes in the previous week,...

Stock market today: Amazon helps pull Wall Street higher, while yields skid after jobs report

Amazon and oil-and-gas companies are helping to pull U.S. stock indexes higher on Friday, while yields skid in the bond market following a...

LAWMA MD HINTS AT PLANS TO BAN TEXTILE WASTE FROM LANDFILLS

Commends Agency’s Public-Private PartnershipsThe Managing Director/CEO of the Lagos Waste Management Authority (LAWMA), Dr. Muyiwa Gbadegesin, has...

Despite massive western sanctions, Russia is now the fourth largest economy - IMF

The International Monetary Fund (IMF) noted that Russia is now the fourth-largest economy based on purchasing power parity (PPP).This is despite the...

Argentine soyoil premiums surge, surpass US bases

Soyoil premiums in Argentina have surged since the beginning of the month, to trade at one of the highest levels on record since Fastmarkets started...

Les derniers communiqués

-

Adobe Brings Conversational AI to Trillions of PDFs with the New AI Assistant in Reader and Acrobat

Adobe - 21/02/2024

-

Laura Frigenti takes the Helm as Chief Executive Officer of the Global Partnership for Education

Global Partnership for Education - 05/12/2022