Oil and gas giant BP wants to sell its stake in Lightsource BP just four months after completing a full takeover of the renewables developer, as a...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - Aujourd'hui 08:52

Maroc - NEWSDAY.CO.TT - A la Une - Aujourd'hui 08:52

The changing tides of global energy

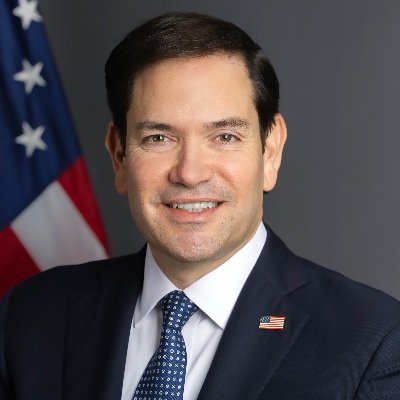

The first quarter of 2025 is not yet complete and it has already been a tumultuous year in terms of energy and moreover, energy transition. Geopolitical tensions, business resets and changes in government policy have changed the landscape of the global energy sector drastically. On the first day of Donald Trump’s presidency, he declared a national energy emergency, challenging oil and gas companies to "drill baby, drill." Months later, in its 2025 capital markets update, energy giant bp announced plans to cut its annual energy transition spending by more than US$5 billion and increase oil and gas investment to around US$10 billion a year. TT, which has more than a century of experience in the energy sector, and is one of the areas where companies such as bp and Shell have explored and produced oil and gas for years, can be affected by these changing tides. Bp in particular showed that it had big plans for TT as it cited several wells in its province for gas production. However, the same geopolitical and business changes that could affect the oil and gas industry could also have a significant impact on TT. Energy companies fuel oil and gas sectors In bp’s capital markets update in February, chief financial officer Kate Thompson pointed out its strategy for the short term, through 2027. It was part of an overall "reset" of the company to boost earnings and improve investor confidence. The reset plan comes on the heels of news of a 35 per cent decline in profits, as reported by international media on February 11. The company experienced a drop in profits to US$8.9 billion, with the fourth quarter profits plummeting to under US$2 billion, the lowest it's been since the fourth quarter of 2020. Thompson said bp plans to set its capital expenditure (capex) between US$13 and US$15 billion a year, with an average of around US$10 billion going to oil and gas investments. She said the oil and gas capex will have a 70-30 per cent split, with oil exploration and production seeing the lion’s share of the investment. The investment would reduce to around US$8.5 billion per year in investment from 2025 to 2027. The oil and gas investment is a 20 per cent increase. She added that energy transition capex will be in the range of $1.5 to $2 billion per year from 2026 to 2027. CEO Murray Auchincloss said the company plans to pursue fewer and higher returning opportunities in energy transition, cutting investment by more than US$5 billion a year. [caption id="attachment_1142613" align="alignnone" width="1024"] A worker installing a pipe as part of bpTT's Ocelot project to replace some 13 kilometres of new pipeline. - Photo courtesy bpTT[/caption] He added the company has no plans for further acquisition in the energy transition. In its plans for growing upstream, bp admitted that it had not invested enough in its oil and gas business and its exploration success hasn’t been the best. It has made 40 discoveries, with TT, Egypt and the Gulf of Mexico among the sites for its discoveries over the past four decades. Bp in its reset strategy said although its gas fields in TT such as Calypso, Kanikonna and Manakin/Cocuina are among its more mature provinces, it is progressing with gas growth options for these fields. It also pointed out that it has invested in several gas projects in TT, including the Cypre, Coconut and Mento platforms, which are in construction, as well as the Ginger platform which is in the design phase. Although it is a turnaround for the company, which in 2020 pledged to reduce oil and gas output by 40 per cent, it bodes well for TT which has been seeking to make itself more marketable in the oil and gas sector. The Ministry of Energy in February officially launched its latest deepwater bid round, during the TT Energy Chamber’s two-day energy conference, from February 10-12. The ministry opened 26 blocks in TT’s deepwater regions off the northern and eastern coast. Senior geologist and team lead for the bid round Kimberly London said in February that the deepwater acreage sits at a depth of 1,000 to 2,500 metres. She said the acreage has huge potential to provide a significant amount of resources if investment is made in exploration. Principal consultant at VSL Consultants Ltd and Chairman of the TT Extractive Industries Transparency Initiative’s steering committee Gregory McGuire said bp’s plans to boost investment in oil and gas could only be good news for TT. [caption id="attachment_1142611" align="alignnone" width="952"] Energy consultant Gregory McGuire -[/caption] "It’s good news. If bp is going to invest in more oil and gas that means it is going to press for more oil and gas from TT. They are already here. They have facilities on the ground and they have a huge investment in Atlantic LNG. It points to a belief that there would be more investment here." He said while companies are consistently looking for better investments elsewhere TT continues to stack up against other provinces as a competitive region. "This particular move by bp to reset means that they are still in the oil and gas game, they have assets on the ground and they will continue to search for resources in TT." Shell in its 2024 energy transition strategy said in 2023, out of its total capex allocation of US$24.4 billion it invested US$5.6 billion in low-carbon solutions. It also reduced its scope one (direct) and scope two (indirect) operations emissions by six-eight per cent in 2023, as compared to 2016. Shell is also more than 50 per cent complete with its target to reduce emissions by 2030. It has reduced total methane emissions by 70 per cent. Wael Sawan, Shell CEO, said while it continues with its transition policies, he believes the demand for oil and gas will continue to be high, but it will have to be produced with lower emissions and alongside cleaner energy such as advanced biofuels, renewable power and hydrogen. Another opportunity comes in the form of LNG as Shell expects it will play a critical role in the transition process. "It continues to provide a secure supply of energy in many European countries. It also offers flexibility to electricity grids as wind and solar power grow, and opportunities to lower carbon emissions from industries such as cement and steel by replacing coal." He said powering LNG plants with renewable electricity and adding carbon capture and storage methods will assist in lowering carbon intensity of its LNG plants. Foreign policies bring gas pains However, it is not all good news for TT. Recent geopolitical conflicts between Venezuela and the US have reared its head once again with Trump making his second stint as US President. US Secretary of State Marco Rubio, in a social media post, said the US intends to reverse all of President Joe Biden’s concessions and licences with Venezuela, one of which involves the popular Dragon gas deal which could give TT access to up to four trillion cubic feet (TCF) of natural gas. [caption id="attachment_1142612" align="alignnone" width="819"] Energy Minister Stuart Young, centre, poses with bpTT staff and staff of the Seven Seas, a pipe-laying vessel docked in Chaguaramas.-[/caption] The licence, issued in 2023, allowed the companies to proceed with planning the project with the aim of reaching first gas by 2027. Mc Guire said the reversal of the licence will make it all the more difficult to complete the deal. "The US has passed its edict and they will proceed, which will make it harder for TT. The government and Shell may continue to pursue the plans but it would be very difficult. "At the end of the day, it is not only a government investment, it is also a Shell investment, because Shell was going for FDI approval." Mc Guire said although there has been a change in the tune of several major oil and gas companies on energy transition and how it should be justly done, TT should not pull back from its own transition exercises. Noting projects such as the utility-scale solar project in Brechin Castle, to which both bp and Shell have invested, Mc Guire said TT’s renewable energy strategy will not only allow it to meet its agreement in the Paris Agreement, but will allow TT to utilise its own fossil fuels in a better manner. "I see no reason why we cannot try to continue to meet our commitments to the Paris Agreement. [caption id="attachment_1142610" align="alignnone" width="1024"] Shell TT senior vice president and country chair Adam Lowmass, left, Prime Minister Dr Keith Rowley, Energy Minister Stuart Young and NGC chairman Dr Joseph Ishmael Khan during a tour of a ship acquired to help plan the exploitation of the Dragon gas field on October 11, 2024 in Chaguaramas. -[/caption] "It is also in our best interest. To move more of our power generation into renewables, it will free up gas for other applications. That is the real driver. "We are looking for gas. With this project, we could use our gas where it would have a higher value rather than using it in electricity.” The post The changing tides of global energy appeared first on Trinidad and Tobago Newsday.

Articles similaires

Experts make the case for AI in energy industry

Artificial intelligence is everywhere. It is in your phones, the video games you play, your search engines, and everywhere else in the digital world,...

Geological job crisis or cycle?

RICARDO MITCHELL US President Donald Trump is a disruptive force. Nations are either recoiling from his declarations or bracing for impact. He has...

Dragon in doubt as Trump trains guns on Maduro's energy deals

ACTING Prime Minister Stuart Young has given the population the assurance he and the government will do all in their power to ensure cross-border...

US seeks to terminate all Venezuela oil, gas licences

THE US is seeking to terminate all oil and natural gas licences with Venezuela that were approved by the former Joe Biden administration. In a post...

BP pulls plug on green transition announcing major oil and gas investment

The company has announced it will increase its oil and gas production to around $10bn a year while cutting its investment in renewables and the...

PM slams Kamla’s attack on Maduro government

THE Prime Minister has condemned Opposition Leader Kamla Persad-Bissessar for trying again to harm the Dragon gas deal between Trinidad and Tobago...

BP slashes green investment

BP is expected to announce it will slash its renewable energy investments and instead focus on increasing oil and gas production. The energy giant...

Ramps CEO optimistic about forex future due to Dragon gas

Despite the continued decline in the availability of foreign exchange, Ramps Logistics CEO Shaun Rampersad is very optimistic about the country’s...

Energy innovation essential

ONE HIGHLIGHT of the recent multi-stakeholder energy conference held at the Hyatt Regency in Port of Spain was an innovation challenge which saw five...

Les derniers communiqués

-

Aucun élément