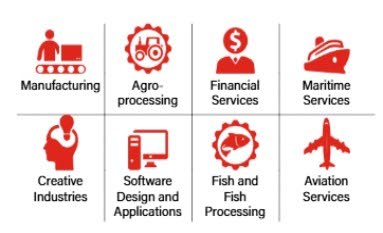

Marc Sandy Grant funding opportunities for micro, small, and medium-sized enterprises (MSMEs) are significant, particularly through the Ministry of...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - Aujourd'hui 08:48

Maroc - NEWSDAY.CO.TT - A la Une - Aujourd'hui 08:48

The role of fintech in MSME financing

Anna Chamley Financial Technology, fondly known as fintech, plays a crucial role in transforming the financing landscape for micro, small and medium-sized enterprises (MSMEs). By leveraging innovative technologies, fintech addresses significant barriers that businesses face, particularly regarding access to capital. Traditional financial institutions often rely on stringent credit evaluations and collateral requirements, which can exclude many MSMEs from accessing loans. MSMEs account for approximately 60 to 70 per cent of the Caribbean's GDP and represent between 70-85 per cent of all businesses in the region. This sector is vital for job creation and economic stability. It is reputed that a large segment of the population remains unbanked, with estimates suggesting that up to two-thirds of the Caribbean's 45 million inhabitants lack access to traditional banking services. This financial exclusion poses significant challenges for MSMEs seeking capital. Fintech companies are developing digital payment systems tailored for MSMEs, facilitating easier transactions and reducing reliance on cash. For instance, Mastercard is actively seeking partnerships to enhance digital payment options for local businesses, particularly small shops. Digital payment platforms enable MSMEs to access financial services that were previously out of reach due to geographical and infrastructural barriers. By offering mobile wallets and online payment systems, these solutions allow businesses to conduct transactions without needing a physical bank presence, which is crucial in remote areas of the Caribbean. Digital payments facilitate economic activity by enabling businesses to engage in e-commerce, which has seen significant growth in the Caribbean. For instance, during the covid19 pandemic, e-commerce traffic in major markets surged by over 150 per cent. This shift allows businesses to reach a wider customer base beyond local markets, thereby enhancing sales opportunities and driving overall economic growth. MSMEs benefit immensely from digital payments. These solutions allow MSMEs to attract more customers and expand their operations online, levelling the playing field with larger businesses. Digital payments also reduce transaction costs and increase efficiency, enabling MSMEs to compete more effectively in local and international markets. Platforms that enable marketplace lending are emerging as viable options for MSMEs to secure financing. These solutions help bridge the funding gap by connecting businesses directly with potential investors. Impact on MSMEs The innovations brought about by fintech are reshaping the financing landscape for MSMEs in several ways: · Increased access to capital: By lowering barriers to entry, fintech solutions enable more MSMEs to secure necessary funding, which is vital for their growth and sustainability. · Enhanced financial literacy: Many fintech platforms provide educational resources that help MSMEs understand their financial options better, fostering improved financial management practices. · Support for economic growth: As MSMEs gain better access to financing, they can invest in expansion, hire more employees, and contribute more significantly to economic development. Digital innovations are particularly beneficial for vulnerable populations within the MSME sector, including women and youth entrepreneurs. By providing tailored financial products that meet their unique needs, fintech solutions promote inclusive growth and help bridge the gender gap in entrepreneurship. The collaboration between fintech companies and development organisations ensures these groups have access to the necessary resources to thrive. Governments in the Caribbean are increasingly recognising the importance of fintech in promoting financial inclusion. Initiatives such as regulatory sandboxes allow fintech companies to test new products while ensuring consumer protection. This supportive regulatory environment fosters innovation and encourages more fintech solutions tailored for MSMEs. By enhancing access to digital payments, alternative lending options and innovative funding mechanisms, fintech not only supports individual businesses but also contributes significantly to the overall economic resilience of the region. As these technologies continue to evolve, they hold the potential to further empower MSMEs and drive sustainable growth across the Caribbean. The post The role of fintech in MSME financing appeared first on Trinidad and Tobago Newsday.

Articles similaires

Cloud Carib, Cisco partner to strengthen regional cybersecurity

AS CYBER threats become more sophisticated, local businesses face mounting risks to their digital security. Recognising the urgency, Cloud Carib, a...

Interswitch Champions Healthcare Innovation at the 2025 HFN Conference

Lagos, Nigeria – March 03, 2025 – Interswitch Group, one of Africa’s leading integrated payments and digital commerce companies, has...

Is e-money a solution in search of a problem?

BitDepth#1499 Mark Lyndersay THE conversation around e-money, digital cash transactions, digital payments and electronic value transfer has been a...

Will UPI change how we shop?

[audio m4a="https://newsday.co.tt/wp-content/uploads/2025/03/BitDepth1500_Narration_03-03-2025.m4a"][/audio] BitDepth#1500 Mark Lyndersay "THE...

Nigerian Navy Microfinance Bank Celebrates 10 Years of Impactful Service and Excellence

The Nigerian Navy Microfinance Bank (NNMFBL) celebrates a decade of growth, resilience, and impact in Nigeria’s microfinance sector, marking its...

Absa Bank Kenya Enhances Prestige Banking for Professionals & Entrepreneurs

Absa Bank Kenya has introduced an enhanced Prestige Banking offering, tailored to meet the financial needs of salaried professionals and...

President Tinubu Pledges Support For Fintech Companies As Flutterwave Seeks Listing On The Nigerian Exchange

President Tinubu said his administration will support businesses in the financial technology sector that provide payment infrastructure services for...

The Priorities For Rebuilding Syria’s Economy – OpEd

After more than a decade of war, destruction and economic collapse in Syria, the country’s new government faces an urgent and formidable...

Emiratron dubai

Emiratron is the pinnacle of digital excellence in Dubai, delivering exclusive, bespoke solutions tailored for visionary local and high end...

Les derniers communiqués

-

Aucun élément