Business Day welcomes the TT Coalition of Services Industries (TTCSI) as its newest columnist. The coalition's weekly columns will look at its...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - Hier 06:47

Maroc - NEWSDAY.CO.TT - A la Une - Hier 06:47

Pivotal role of credit ratings in emerging markets

Business Day welcomes the TT Coalition of Services Industries (TTCSI) as its newest columnist. The coalition's weekly columns will look at its operations, membership and overall contributions of the services sector to the socio-economic landscape of TT. DERECK RAJACK With its roots stretching back to 2004, Caribbean Information and Credit Rating Services Ltd (CariCRIS) has established itself as the region's leading credit rating agency. Built on a foundation of strong institutional backing, CariCRIS brings together the region's most important financial stakeholders, with shareholdings by regional central banks, multilateral development banks and major Caribbean financial institutions. The agency's technical capabilities are further enhanced through its partnership with CRISIL – a CariCRIS shareholder and Standard & Poor's associate company – bringing global best practices to the Caribbean context. Established to serve the Caribbean's unique financial ecosystem, CariCRIS provides regional and national scale ratings that offer a comprehensive assessment of creditworthiness relative to other Caribbean entities. These ratings serve as essential tools for investors, creditors and other stakeholders in evaluating investment and lending decisions within the regional context. Credit ratings play a pivotal role in emerging and developing markets, serving as independent references of creditworthiness and catalysts for market development. In the context of the Caribbean, the impact is particularly significant. Through standardised and objective assessments, credit ratings foster transparency in financial markets and help reduce the information gap between issuers and investors. This work is instrumental in supporting the development of local currency bond markets and enabling more accurate pricing of debt instruments. Perhaps most importantly, regional credit assessment facilitates cross-border investments within the Caribbean, creating a more integrated financial market. For regional enterprises, the process of obtaining a credit rating from CariCRIS is straightforward. It involves a company submitting its financial and operational data to CariCRIS and facilitating meetings with the company's executive team. The agency's experienced analysts then thoroughly evaluate factors such as the company's financial health, market position, strategy and management quality. Once the assessment is complete, the company receives its credit rating, which is assigned by an independent committee. [caption id="attachment_1131671" align="alignnone" width="1024"] Dereck Rajack, CEO of CariCRIS -[/caption] Being rated can result in a number of advantages. First and foremost, a credit rating can enhance access to funding. Rated companies can tap into diverse funding sources, including bonds, commercial paper and bank financing. Moreover, depending on the rating, these companies can often negotiate more favourable interest rates and terms, directly affecting their bottom line. The benefits of a credit rating extend to a company's market position as well. Rated companies demonstrate their commitment to transparency and good governance, which typically leads to improved relationships with suppliers and customers. This enhanced credibility can translate into better negotiating power in business dealings and increased confidence from all stakeholders. The rating process itself delivers valuable operational insights. Through independent assessment of business operations, companies gain a clear understanding of their strengths and areas for improvement. This evaluation provides an opportunity to benchmark against regional peers, often leading to enhanced internal controls and risk management practices. Furthermore, a rating increases a company's visibility in the market. This heightened profile can attract new investors and business partners, create strategic alliance opportunities, generate enhanced media coverage and build greater customer trust. These benefits combine to create a stronger, more competitive market position. The findings and outcome of the rating process are documented in a comprehensive rating report. All rating reports provide a list of factors that can individually or collectively lead to the entity being upgraded or downgraded – these are called rating sensitivity factors. Where a company's rating experiences a decline or downgrade, the rating sensitivity factors provide insight into the key issues that need to be addressed to improve the rating. This might include improving key financial metrics, suggestions for strengthening financial management practices, improving operational efficiency or enhancing corporate governance structures. [caption id="attachment_1131672" align="alignnone" width="1024"] -[/caption] The same is true for entities seeking upgrades to their rating. The agency maintains regular monitoring and engagement with the rated company and does a complete annual review on the anniversary of the rating. Companies can achieve positive rating revisions by demonstrating sustained improvement in the identified areas of concern. As the Caribbean's credit rating agency, CariCRIS plays a key role in strengthening regional financial markets through its specialised rating services. By providing regional and country-specific assessments, the agency facilitates cross-border investment and enables organisations to access diverse funding sources within their home markets and across the wider Caribbean region. Across the Caribbean region, credit ratings are being increasingly incorporated into financial regulation. Regulatory bodies now integrate rating requirements into their oversight frameworks, using them to assess institutional risk and determine appropriate capital requirements. As this trend continues and as ratings eventually become a requirement for certain activities, rated instruments should gain increased market liquidity, benefiting both issuers and investors throughout the region. As Caribbean businesses continue to evolve and seek growth opportunities, credit ratings become an increasingly vital tool for success. Whether seeking to raise capital, enhance market presence or improve operational efficiency, a CariCRIS rating provides valuable benefits for business growth and market development. The path to a more vibrant and interconnected Caribbean financial market requires solid institutions and reliable market infrastructure. CariCRIS has fulfilled its role as an independent credit rating agency for nearly two decades. Through its work, CariCRIS is not just rating companies, it's helping to build a more robust, more integrated Caribbean economy for the future. As a member of the TTCSI, we consider it imperative for our business leaders to fully comprehend the value of credit ratings from all viewpoints, which include but are not limited to good corporate governance standards, transparency and accountability, as we seek to further strengthen the operations of our various organisations. The post Pivotal role of credit ratings in emerging markets appeared first on Trinidad and Tobago Newsday.

Articles similaires

Businesses call for focus on vulnerable sector for 2025

The year 2024 was a big year for economic diversification, with the manufacturing sector continuing its upward expansion and engagement through trade...

Embraer: The Latin American jets coming to CAL

Embraer SA is a Brazilian multinational aerospace corporation that designs and manufactures a wide range of aircraft. Embraer is the third largest...

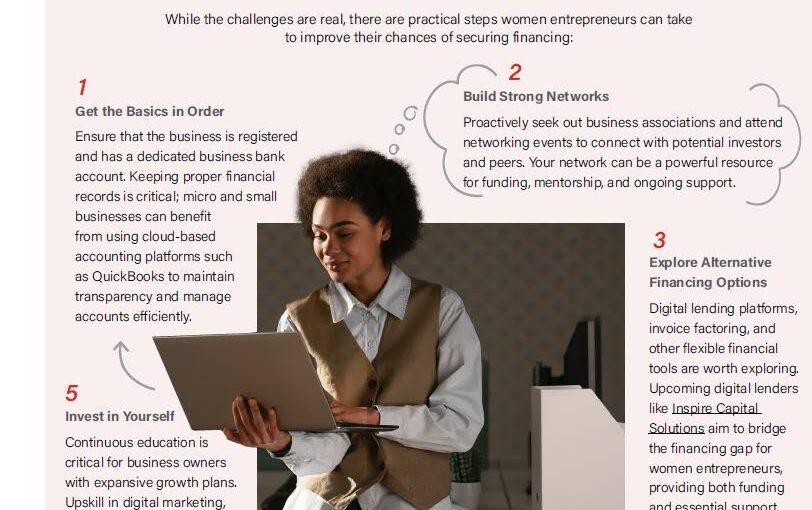

Closing the financial divide: Strategies for women-led businesses

Kieran Valley-Gordon In TT, women own just 30 per cent of the approximately 20,000 registered micro, small and medium-sized enterprises (MSMEs),...

Closing the financial divide: Strategies for women-led businesses

Kieran Valley-Gordon In TT, women own just 30 per cent of the approximately 20,000 registered micro, small and medium-sized enterprises (MSMEs),...

Indian household debt rising but relatively low compared to other emerging markets: RBI Report

Household debt in India has increased to 42.9% of GDP as of June 2024, driven mainly by a rise in the number of borrowers. Most borrowing is for...

Indian household debt rising but relatively low compared to other emerging markets: RBI Report

Household debt in India has increased to 42.9% of GDP as of June 2024, driven mainly by a rise in the number of borrowers. Most borrowing is for...

Charting the future: Vision of a resilient, productive 2025

VASHTI G GUYADEEN As 2025 begins, the TT Chamber reflects on a year of transformative progress and pragmatic optimism. Against a backdrop of global...

Connected Caribbean Summit makes the case for functional, tangible regional integration

The Connected Caribbean Summit, now in its third year, has been hailed as a highly organised event with compelling ideas and presentations that...

Chinese Companies Expanding Abroad Must Strike A Balance Between ‘Growth’ And ‘Cost’ – Analysis

By Chen Li Chinese companies are riding a new wave of "going global,"driven by a strong enthusiasm to expand into overseas markets, targeting...

Les derniers communiqués

-

Aucun élément