For the first time in a decade, the International Monetary Fund (IMF) found TT has undergone gradual and sustained economic recovery in 2024. A press...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - Hier 03:32

Maroc - NEWSDAY.CO.TT - A la Une - Hier 03:32

TT Chamber: Raise tariffs on luxury items, promote local alternatives

The persistent foreign exchange (forex) shortage remains a significant threat to the survival of businesses, particularly small-and medium-sized enterprises (SMEs) across various sectors, and to the broader national economy. This stark warning was issued by the TT Chamber in its report, Challenges in Accessing Foreign Exchange: Business Insights, released on January 22. Based on a survey of its membership, the report delved into the factors driving the crisis and recommended urgent reforms to stabilise the forex market. Among the most notable findings was the significant gap between forex demand and supply, despite the Central Bank injecting an estimated US$100 million per month into the banking system. According to the survey, 58.6 per cent of businesses receive less than 25 per cent of their monthly forex requirements from commercial banks. This shortfall, the chamber showed, has far-reaching consequences, with 62.2 per cent of businesses reporting delays in paying suppliers and 59.5 per cent experiencing declining profitability. The strain is particularly acute for SMEs, which face systemic disadvantages in accessing the limited forex available. Kiran Maharaj, president of the TT Chamber, stressed the importance of addressing challenges during discussions with government officials and policymakers. “(We expressed) our gratitude to the Minister of Finance Colm Imbert and the governor of the Central Bank for their recent engagements, which provided an opportunity to share insights and explore potential solutions,” Maharaj said. [caption id="attachment_1134325" align="alignnone" width="1024"] Kiran Maharaj, TT Chamber president. - Photo by Faith Ayoung[/caption] She warned, however, that a failure to resolve these issues could lead to further erosion of economic stability. The survey was done between November 13 and December 12 and highlighted the operational challenges caused by forex shortages. The delays in accessing foreign currency disrupted supply chains but forced businesses to scale back operations. Over 20 per cent of companies report struggles in procuring raw materials, leading to production delays and reduced product offerings. These challenges were reportedly compounded by systemic inequities in forex distribution, with 69 per cent of businesses perceiving a lack of transparency and fairness in the allocation process. Larger companies appear to receive preferential treatment, leaving SMEs – TT's economic backbone – unable to compete effectively. The report found that consumption patterns have not adapted to the reduced availability of forex. Businesses and consumers continue to demand levels of foreign currency that the system cannot sustain, exacerbating the supply-demand imbalance. The report identified a need for behavioural changes alongside structural reforms. "Launch targeted awareness campaigns encouraging the purchase of locally produced goods," it suggested. "Educate businesses and individuals on responsible forex usage to reduce demand pressures; and advocate for private-sector-led initiatives to improve supply chain efficiency and reduce reliance on imported inputs." CEO Vashti Guyadeen said the chamber was committed to data-driven solutions. "As part of our strategic vision, the chamber will conduct more targeted surveys to enhance decision-making and bolster our data analytics capabilities. "By doing so, we aim to provide deeper insights into the forex challenges and support businesses in navigating these issues. [caption id="attachment_1134326" align="alignnone" width="1024"] Vashti Guyadeen, CEO of TT Chamber - Photo by Faith Ayoung[/caption] "Additionally, we remain committed to helping our members explore opportunities in emerging sectors such as agriculture, agro-processing, renewable energy, creative industries, ICT, knowledge-based services and manufacturing, which hold potential for forex generation and economic diversification.” Economic diversification was a central theme of the chamber’s recommendations. The chamber said the industries like agro-processing and manufacturing offer opportunities for forex generation and promise to build resilience against external shocks. The chamber also recommended a managed exchange rate policy and suggested transitioning to a managed float system to better align forex supply with demand. While acknowledging the risks of inflation and market volatility, the chamber said this approach could provide a more sustainable solution to the forex crisis. Engaging stakeholders through education and dialogue will be essential to building consensus on this policy shift. Support for SMEs and exporters also featured prominently in the chamber’s action plan. It suggested expanding forex facilities for SMEs, streamlining application processes and reducing collateral requirements could provide much-needed relief to smaller businesses. Incentivising exporters to repatriate earnings and offering grants for export readiness were also tipped as vital steps to bolster the country’s forex reserves. The report also proposed reducing non-essential forex demand by imposing higher tariffs on luxury imports and capping allocations for non-priority items. Surveying consumers purchasing foreign products, the chamber reported a clear majority (76.6 per cent) considered this "a low priority, preferring the forex to be directed toward more impactful sectors. "The responses suggest a clear consensus for allocating foreign exchange to businesses and activities that support essential needs, economic resilience and foreign exchange generation. “Personal and luxury uses are seen as less significant." Respondents regarded health and healthcare-related imports beyond pharmaceuticals, foreign education, trade and supply chain support, and immigration and family support as "high priority" and luxury and non-essential items (like cars and firecrackers), and individual consumer shopping (abroad or online) as "low priority." The chamber suggested enhanced transparency and oversight in forex allocation by introducing automated, artificial intelligence-driven systems “for equitable and transparent forex distribution to eliminate perceived favouritism and inefficiencies. "Secondly, mandate periodic public disclosures from banks on forex allocation data to ensure accountability and equitable access across industries. "Thirdly, develop clear and objective criteria for forex allocation, prioritising businesses that contribute significantly to exports and economic diversification." The post TT Chamber: Raise tariffs on luxury items, promote local alternatives appeared first on Trinidad and Tobago Newsday.

Articles similaires

Chambers: Positive business outlook for 2025

For the first time in a decade, the International Monetary Fund (IMF) found TT has undergone gradual and sustained economic recovery in 2024. A press...

The real struggles of Trinidad and Tobago economy

RUSHTON PARAY THE RECENT IDB report claiming significant productivity growth in TT over the last four years seems disconnected from the harsh...

Cultivating a thriving innovation ecosystem

Emerson John-Charles Innovation-driven economies are renowned for their diversification, export orientation and ability to generate crucial foreign...

ATTIC seeks higher priority for forex allocations

The Association of TT Insurance Companies (ATTIC) is seeking a higher priority level for the provision of insurance services to be recognised as...

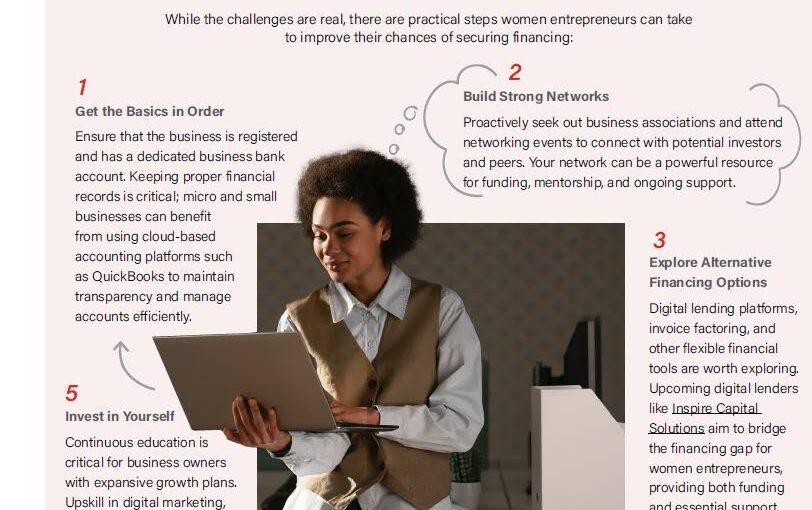

Closing the financial divide: Strategies for women-led businesses

Kieran Valley-Gordon In TT, women own just 30 per cent of the approximately 20,000 registered micro, small and medium-sized enterprises (MSMEs),...

Closing the financial divide: Strategies for women-led businesses

Kieran Valley-Gordon In TT, women own just 30 per cent of the approximately 20,000 registered micro, small and medium-sized enterprises (MSMEs),...

Caribbean Blue Waters: Company shares market expansion, export plans

Blue Waters Products started in 1999 with only 12 employees, which included one salesman, and two trucks. Now, some 26 years later, the Blue Waters...

Caribbean Blue Waters: Company shares market expansion, export plans

Blue Waters Products started in 1999 with only 12 employees, which included one salesman, and two trucks. Now, some 26 years later, the Blue Waters...

PriceSmart: Forex conversion woes in Trinidad and Tobago

PRICESMART is having difficulties accessing foreign exchange, reporting in its quarterly report for the period ending November 30 that it held...

Les derniers communiqués

-

Aucun élément