On October 23, the EU Council finalized, through a written procedure, the allocation of a macro-financial loan to Ukraine in the amount of €35...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - 11/Aug 17:13

Maroc - NEWSDAY.CO.TT - A la Une - 11/Aug 17:13

Central Bank warns against heightened cybercriminal activities

The Central Bank of TT (CBTT) says cybercriminals are constantly evolving their tactics, techniques and procedures as it urged all citizens to be vigilant against cybercrimes such as phishing, identity theft, internet fraud and banking fraud. In a notice posted on its official website, the CBBT said that people in order to enhance their online security, should always update their operating systems and applications to the latest versions to benefit from security upgrades. In addition, the CBTT said that people should learn how to use digital technologies safely and responsibly. “This includes practising good password hygiene, enabling multi-factor authentication, and being cautious about the information you share online,” it said, adding that they should enable multi-factor authentication (MFA) on any account that offers it, to add an extra layer of security “Be cautious of unsolicited e-mails, links, and attachments. Verify the source before clicking,” the CBTT said, urging citizens to use strong passwords for their Wi-Fi networks and avoid using public Wi-Fi for sensitive transactions. Meanwhile, the CBTT said that the net errors and omissions of TT’s balance of payments returned to over US$2 billion in 2022 and 2023, following a dip during the period of the covid19 pandemic. The Central Bank’s publication of a note on errors and omissions in the country’s balance of payments came after economist Marla Dukharan published a report on July 31, indicating that on average over US$2 billion “disappears” annually from the country in errors and omissions. The economist said that on a per capita basis, TT is the world’s largest loser of foreign currency. But the CBTT, indicating that the publication of the note is the first in a new series that aims to explain important concepts and monetary policy actions to a broad public audience in non-technical terms, explained that the balance of payments is “a statistical statement that summarises financial transactions between residents of an economy and non-residents (or the rest of the world) during a period.” It said that the balance of payments comprises the current account, the capital account, the financial account and the overall balance. The net errors and omissions represent a balancing item in the balance of payments of a country. TT’s current account, which shows the flows of goods, services, primary income and secondary income between residents and non residents, in 2023, recorded a positive surplus on its current account of US$3.39 billion. The CBTT said the capital account transactions are “relatively small,” but the financial account, which shows transactions between residents and non residents that involve financial assets and liabilities, recorded a net outflow of US$1.60 billion. “The overall balance represents the change in international reserves managed by the Central Bank over the period. In 2023, the change in international reserves was US$736.1 million,” said the Central Bank, adding that in principle, the balance of payments must balance, meaning the overall balance must be equal to its components, the current, capital and financial accounts. The CBTT said that it collects data on the country’s balance of payments from primary sources, such as the Central Statistical Office, the Ministry of Energy and Customs. But it also collects data from surveys involving private and public institutions. “As noted earlier, errors by reporting agencies, and more so incomplete coverage of transactions constitute the errors and omissions in the balance of payments.” The CBTT said two issues in the sphere of incomplete coverage are: the measurement of travel expenses and the response rate of companies to the Central Bank’s survey requests being about 50 per cent. It noted that errors and omissions were US$2.36 billion in 2023 and US$2.07 billion in 2022, but only US$90.5 million and US$132.6 million in 2021 and 2020 respectively. In 2019, errors and omissions totalled US$1.10 billion. The post Central Bank warns against heightened cybercriminal activities appeared first on Trinidad and Tobago Newsday.

Articles similaires

Ex-minister Mariano Browne: Treat forex like any other commodity

ECONOMIST and former PNM minister in the Ministry of Finance Mariano Browne said foreign exchange should be treated like any other commodity, and...

Moniepoint secures US$110m funding to scale digital payments and banking solutions

Africa’s fastest-growing financial institution, Moniepoint Inc has successfully raised US$110 million in equity financing, to power the dreams of...

Youth entrepreneur: Forex shortage tantamount to being financially trapped

YOUTH entrepreneur Keron Rose has described the situation with respect to foreign exchange (forex) distribution as being similar to being financially...

Mobile wallets cement status as most popular form of contactless payment

Central Bank statistics show card payments overall declined in September compared to August, but contactless and NFC transactions have surged over...

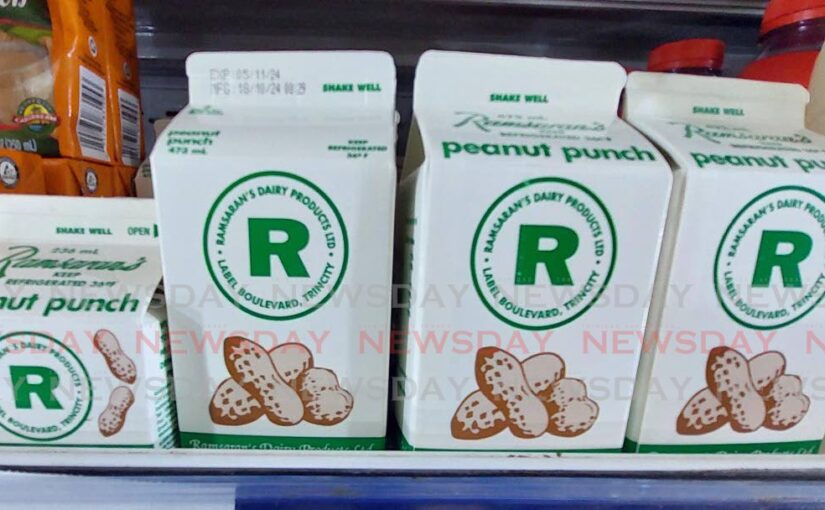

Ramsaran Dairy founder complains to Central Bank, IMF, Auditor General on forex challenges

A local manufacturer has written to the Central Bank governor, the Auditor General, and the International Monetary Fund (IMF) complaining about the...

Real-Time Payments to Boost Global GDP By $285.8 Billion, Create 167 million New Bank Account Holders By 2028

Last Updated 6 hours ago by Kenya Engineer Real-time payments are forecast to generate $285.8 billion of additional global GDP growth and create more...

Five things to watch from the Bank of Canada interest rate decision

OTTAWA — The Bank of Canada will release its interest rate decision and monetary policy report on Wednesday. Here are five things to look for in...

Five things to watch from the Bank of Canada interest rate decision

The Bank of Canada will release its interest rate decision and monetary policy report on Wednesday. Here are five things to look for in the decision...

European Commission welcomes G7 consensus on EUR 45B in financial assistance to Ukraine

The European Commission has welcomed the announced consensus reached by the Group of Seven leaders to collectively provide financial assistance to...

Les derniers communiqués

-

Aucun élément