YOUTH entrepreneur Keron Rose says he understands the concern that people have over the restriction on the use of their debit cards to make US-dollar...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - 09/Sep 07:41

Maroc - NEWSDAY.CO.TT - A la Une - 09/Sep 07:41

Why cash is king in Trinidad and Tobago

[audio m4a="https://newsday.co.tt/wp-content/uploads/2024/09/BitDepth1475_Narration_09-09-2024.m4a"][/audio] BitDepth#1475 Mark Lyndersay LAST MONTH the TT International Finance Centre (TTIFC) issued a summary of the results of its survey of financial inclusion in this country The Digitalisation of Payments and Inclusion (DPI) Survey, which the TTIFC will use to design its national financial inclusion strategy, found, to nobody's surprise, that despite efforts to transition TT society to a cashless society, we want to hold on to our dollars. What is money? It is any medium of exchange that is centralised, generally accepted, recognised by all parties and acts to facilitate transactions of goods and services. It is value codified. Its value as legal tender for that value can vary widely. The TT dollar is essentially useless outside this country. Even the US dollar, while widely accepted as a representation of value, will sometimes fall into national sinkholes around the world where it has no value at all. So the value of a financial instrument is what we say it is. Collectively, we are saying that cash is better than credit cards, debit cards and online transfers. We are also saying, to an alarming degree, "fiyah bun banks." The percentage of citizens who have a bank account has dropped from 81 per cent in 2017 to 75 per cent in 2023. Only 52 per cent of the more than 2,000 survey respondents preferred to save their money in a bank. Eighty-two per cent preferred to save their money at home. In the conclusion of the report was the following, "A concerning 41 per cent of the financially excluded believe they do not possess adequate funds to register an account. "This sentiment is pervasive across all demographic groups, underscoring that costs associated with maintaining these accounts are disproportionate to the amounts that such consumers may save or hold in their accounts. This is a significant disincentive to opening, maintaining, and using an account. "The preference for cash, perceived as 'free' by users, further accentuates this point." That cost is borne by the State as part of its duty to manage the economy. If you go shopping with a $50 bill, at the end of your spree you will have exchanged the cash for $50 worth of goods or services and the merchants you patronised will have each received their portion. If you pay with a debit card at a point of sale terminal, there is a fee, which can range between free and $4, depending on who issued the terminal. Does anyone check that? No, because you can't choose to use another terminal to pay. Some banks also charge a fee on declined transactions (the Central Bank's record of electronic payments fees is here: https://cstu.io/306714). Credit cards are even more costly. Micro merchants and small businesses (MSMEs) almost universally don't want to accept credit cards as a payment instrument because each transaction costs them three to four per cent of the payment. These concerns have led to debit card adoption dramatically outpacing credit cards among the banked. In 2017, 16 per cent of users owned a credit card, a figure that dropped to 15 per cent by 2023. By contrast, debit cards were held by 61 per cent of the banked in 2017, rising to 88 per cent in 2023. Far and away the best and least expensive option for transferring money online is the Automated Clearing House, which rose to prominence during covid lockdowns and adds a flat fee per transaction of between $1 and $3 that's usually deducted from the account of the payer. It's a lot to keep track of, and banks do a terrible job of explaining these issues to their customers, largely leaving them to find their way by trial and payment. If you have a sense that maybe I'm not a champion of the local banking system, well there's a lot of words available on why (https://cstu.io/214601). The challenge for the TTIFC is daunting. The banking community offers lip service to the cashless society concept. A quarter of adults do not have a banking account and 13 per cent do not have the documentation to open one. More than half do not understand how to use a mobile banking app. Finance Minister Colm Imbert wants the country to go cashless, but doing more of what isn't working won't change anything. Any solution will need to specifically target the needs of customers who are not being addressed by the banking sector and that won't make those institutions happy. But there are thousands of unbanked citizens who are not being addressed by the financial products today. Until that changes, nothing will. Mark Lyndersay is the editor of technewstt.com. An expanded version of this column can be found there The post Why cash is king in Trinidad and Tobago appeared first on Trinidad and Tobago Newsday.

Articles similaires

Ex-minister Mariano Browne: Treat forex like any other commodity

ECONOMIST and former PNM minister in the Ministry of Finance Mariano Browne said foreign exchange should be treated like any other commodity, and...

Real Unveils Real Wallet: Empowering Agents with Exceptional Financial Flexibility

Unique product offering taps into an agent’s complete earnings picture to provide more financial freedom, while positioning Real at the forefront...

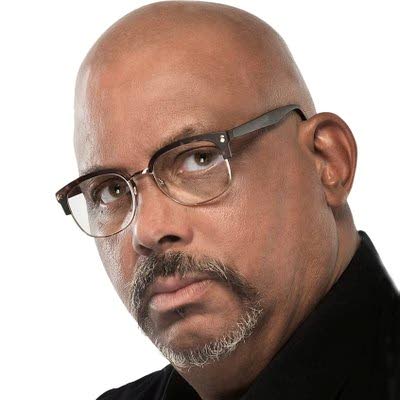

Youth entrepreneur: Forex shortage tantamount to being financially trapped

YOUTH entrepreneur Keron Rose has described the situation with respect to foreign exchange (forex) distribution as being similar to being financially...

Ex-top Trump White House official calls for ‘male only’ voting

John McEntee, who served as the Director of the Trump White House Presidential Personnel Office, in a 2023 video said the U.S. should have “male...

Tobago business groups: SMEs feeling forex pinch

SMALL and medium-sized enterprises (SMEs) in Tobago are being gravely affected by the shortage of foreign exchange in the country, says Tobago...

A shaky start

THE virtual meeting called by the Chief Personnel Officer, Commander Dr Daryl Dindial, on October 24, was met with almost universal derision by the...

The digital euro: What’s in it for you?

By Piero Cipollone As they juggle various cards, apps and devices, most Europeans find that digital payments have fallen short of their promise to...

The digital euro: What’s in it for you?

By Piero Cipollone As they juggle various cards, apps and devices, most Europeans find that digital payments have fallen short of their promise to...

Việt Nam aims to produce innovative medicines

According to the ministry’s Drug Administration of Việt Nam (DAV), innovative drugs in Việt Nam account for only about 3 per cent of the...

Les derniers communiqués

-

Aucun élément