ONE YEAR ago, Minister of Finance Colm Imbert pledged to hold discussions on “the most appropriate policy for the allocation, management and...

Vous n'êtes pas connecté

- English

- Français

- عربي

- Español

- Deutsch

- Português

- русский язык

- Català

- Italiano

- Nederlands, Vlaams

- Norsk

- فارسی

- বাংলা

- اردو

- Azərbaycan dili

- Bahasa Indonesia

- Հայերեն

- Ελληνικά

- Bosanski jezik

- українська мова

- Íslenska

- Türkmen, Түркмен

- Türkçe

- Shqip

- Eesti keel

- magyar

- Қазақ тілі

- Kalaallisut ; kalaallit oqaasii

- Lietuvių kalba

- Latviešu valoda

- македонски јазик

- Монгол

- Bahasa Melayu ; بهاس ملايو

- ဗမာစာ

- Slovenščina

- тоҷикӣ ; toğikī ; تاجیکی

- ไทย

- O'zbek ; Ўзбек ; أۇزبېك

- Tiếng Việt

- ភាសាខ្មែរ

- རྫོང་ཁ

- Soomaaliga ; af Soomaali

Rubriques :

Maroc - NEWSDAY.CO.TT - A la Une - 27/Aug 07:57

Maroc - NEWSDAY.CO.TT - A la Une - 27/Aug 07:57

Unfinished business

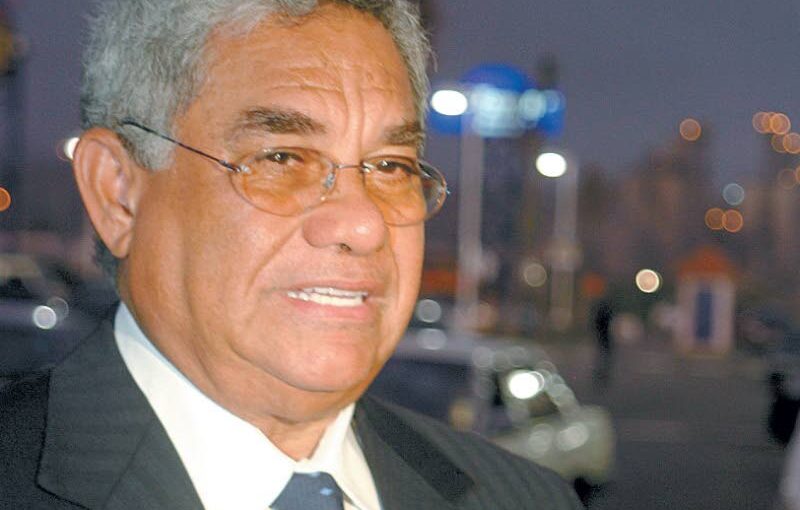

YOU COULD describe the rise and fall of Lawrence Duprey as Shakespearian, but there is a more immediate archetype available to describe him: the smart man. The smart man is perhaps most memorably captured in the writing of VS Naipaul, who once said, “Trinidad has always admired the ‘sharp character’ who, like the sixteenth-century picaroon of Spanish literature, survives and triumphs by his wits in a place where it is felt all eminence is arrived at by crookedness.” Whatever his virtues, Mr Duprey, who has died at 89, turned out to be exactly this: full of eminence existing alongside crookedness. The deceased business magnate presented himself as a noble figure tackling poverty, providing employment and contributing to society. Yet, his reputation for voraciously gobbling assets to divert revenue streams into other ventures was infamous. His empire was founded on insurance, an industry that is all about managing risk. Yet, few investors gambled more than he. The contradictions persist even after death. President Christine Kangaloo, in a statement reacting to Mr Duprey’s passing, said he was “recognised as a visionary” whose “philanthropic contributions” left a lasting mark. Yet, Ms Kangaloo sits in the very office that formally convened a commission of enquiry into the affairs of the CL Financial group, an enquiry that made, according to a summary given by the Prime Minister in 2016, “a number of adverse findings of criminal misconduct of a kleptocratic nature.” Eminence, crookedness. The Colman Report should have been published. (It was – misguidedly, it turns out – withheld from publication by Dr Rowley, who cited a noble wish not to endanger action by law enforcement.) However, what emerged from the enquiry proceedings, broadcast live on television and open to the public, was indictment enough. Executives had flagrant conflicts. Over-leveraging and unacceptable inter-company transactions within the CL Financial group imperilled the insurance business, including Clico. Auditors raised alarm bells over hasty acquisitions and sales and diluted oversight. Insurance money went all over. Regulation was tepid, political connections strong. It was a stark contrast to the frugal reputation of Mr Duprey’s uncle, Cyril, from whom he inherited the reins of Clico. Cyril Lucius Duprey, not his nephew, founded Clico in 1936 amid much adversity after the idea came to him while abroad in 1927. Cyril came back to the country and would later be awarded the Order of the British Empire in 1956, then the Trinity Cross in 1977. Lawrence Duprey, on the other hand, would die having never cleared his name in court. He refused to face questioning at the enquiry. He remains a paradox: larger-than-life, but unknowable. He has left behind, literally, unfinished business. That business has, thus far, cost the country that bailed him out $30 billion. The post Unfinished business appeared first on Trinidad and Tobago Newsday.

Articles similaires

Revealed: New York Times' Haberman explains Trump's reasons for latest 'trolling exercise'

Donald Trump has raised eyebrows for his decision to host a rally at Madison Square Garden in New York, which is not a swing state, but Maggie...

Busted: GOP congressman's campaign blew almost $150K on steakhouses, booze, and Uber

An embattled first-term Republican in a battleground district has been hit with yet a new scandal, as CNN reports his campaign spent six figures on...

Industry Players Harp on Transparency and Inclusive Policy-Making to Stimulate Economic Growth

Mr. Thomas Adams, General Manager, Japan Tobacco International Nigeria; with Mr. Gabriel Idahosa, President and Chairman of Council, Lagos Chamber...

Window into forex problem

THE GOVERNMENT’S decision to resume the importers’ limb of the EximBank’s preferential access window – at a reduced allocation of US$25...

Celebrating 50 Years, Jumbo Electronics Reflects On Its Role In Dubai’s Transformation Into A Global Tech Destination

Fifty years ago, a visionary stepped off an Air India Jumbo Jet in Dubai, and his dream was set to take off. That was Mr. Manohar Rajaram...

Celebrating 50 Years, Jumbo Electronics Reflects On Its Role In Dubai’s Transformation Into A Global Tech Destination

Fifty years ago, a visionary stepped off an Air India Jumbo Jet in Dubai, and his dream was set to take off. That was Mr. Manohar Rajaram...

'Truth Social is dead in the crib' after election win: analyst

Donald Trump's Truth Social platform may have its future as a viable — yet money-losing — site impacted now that the former president is headed...

'Until I realized that IDF soldiers had really come to rescue me, I was in shock'

Louis Norberto Har, who was taken hostage with his partner and her family, was released in a major IDF operation in Rafah. Despite the fanfare, he...

AIICO Insurance: Partnership by Stakeholders Necessary to Grow Agric Sector

Making a presentation on Agricultural Insurance at the annual AIICO Insurance training for members of the Nigerian Association of Insurance and...

Les derniers communiqués

-

Aucun élément